ITR-6

1.WHAT IS ITR & WHAT ARE THE TYPES OF INCOME TAX RETURNS?

ITR stands for Income Tax Return, it is a form through which the amount of income earned, and taxes paid by the person during a particular year is communicated to the Income Tax Department.

Types of Income Tax Return

• ITR 1(also known as SAHAJ) for individuals.

• ITR 2 for individuals having capital income.

• ITR 3 for individuals having business income.

• ITR 4 for individuals declaring income under presumptive scheme.

• ITR 5 for llp & partnership firms.

• ITR-7 for ngo, trust, societies claiming benefits of 12a & 80g.

.

2.WHO IS ELIGIBLE TO FILE ITR-6?

Following are eligible to file ITR-6: –

• The Companies registered under the Companies Act, 2013 or Companies Act, 1956 are eligible to file ITR-6.

.

3.WHO ARE NOT ELGIBLE TO FILE ITR-6?

ITR-6 cannot be filed by: –

• Limited Liability Partnership (LLP)

• Trust/ Ngo/ Societies registered under their respective heads.

• Companies having income from property held for religious or charitable purposes.

.

4.TYPES OF INCOME THAT CAN BE SHOWN IN ITR-6?

Following are the types of income that can be shown in ITR-6(Income of eligible persons from below mentioned source can be shown in ITR-5)

• Income from sale of capital asset.

• Income from house property.

• Income from winning a lottery.

• Commission income from insurance business.

• Income from engagement in activity of owning & maintaining racehorses.

• Income that is subject to special rates.

• Income from business or profession.

• Income from other sources like interest, dividends etc.

.

5.DOCUMENTS REQUIRED TO FILE ITR-6?

Following documents are required while filing ITR-6

• Interest certificates from banks. Post office, Nbfc etc.

• Investment details (if any).

• Donation receipts. (if any).

• Profit & loss accounts.

• Capital gain summary (if any)

• Rent receipts if income is from house property.

.

NOTE:

Since ITR’s are annexure less forms the above-mentioned documents are not to be attached with the ITR Form. However, one needs to keep these documents as it can be demanded by the tax authorities during assessment, inquires.

.

6.HOW TO FILE ITR-6?

By following the steps mentioned below one can file ITR-6

.

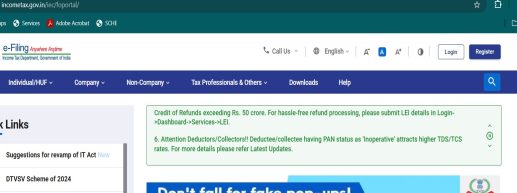

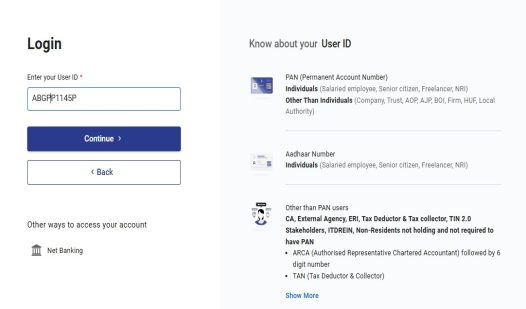

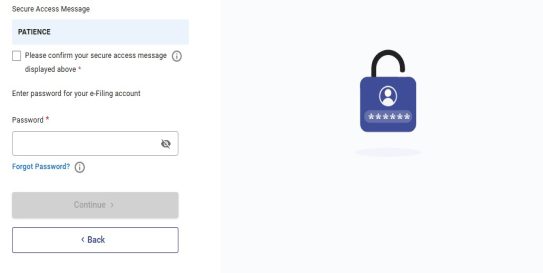

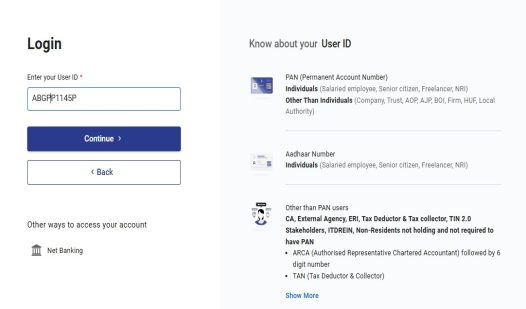

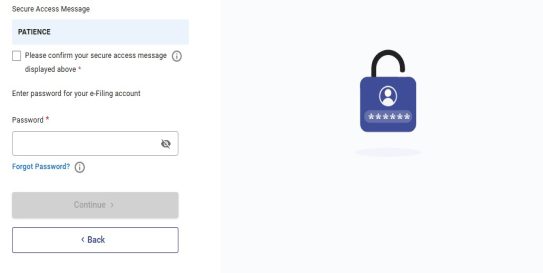

• Click on login and enter your pan & password to login to the income tax portal.

.

.

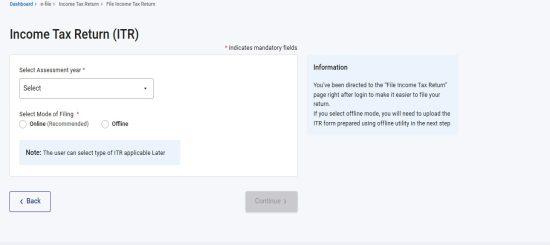

• Click on e-file, then click on file income tax returns.

.

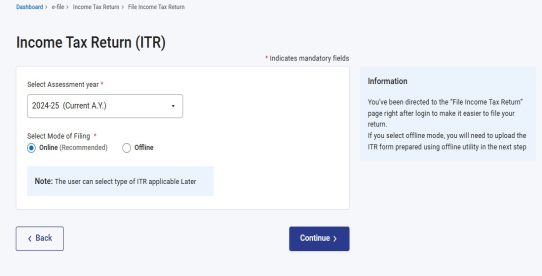

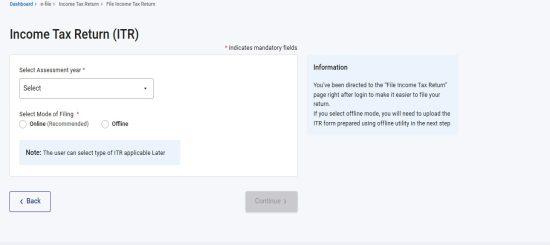

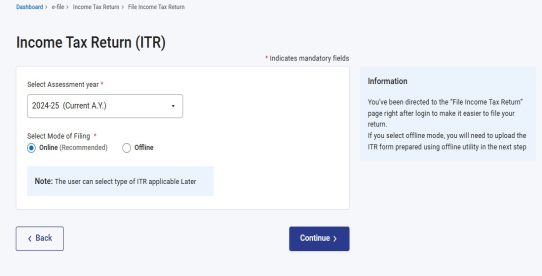

• Select the assessment year for which you want to file ITR and select the mode of filing (here we are telling about online filing procedure)

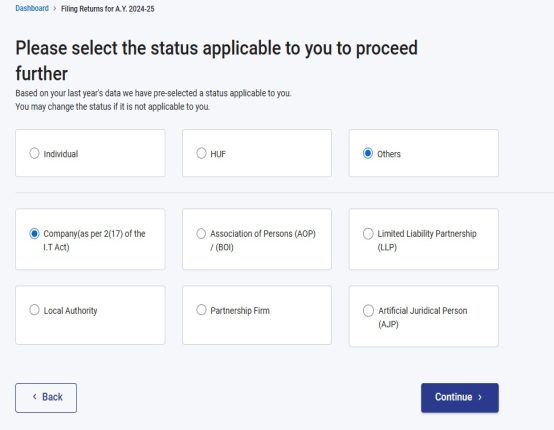

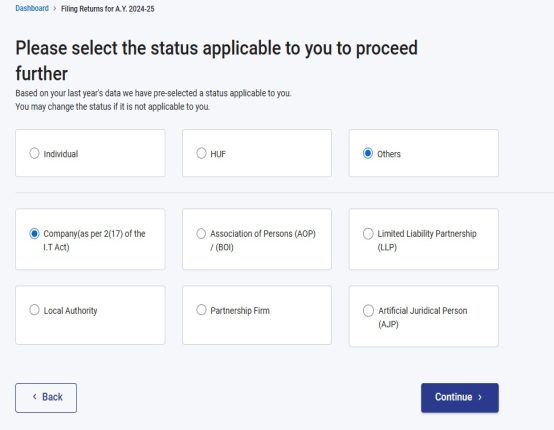

• The next step is to select the status of the entity for which you are filing ITR.

.

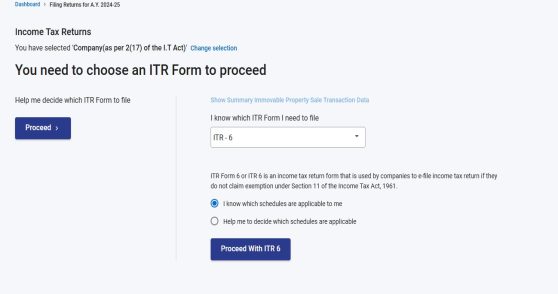

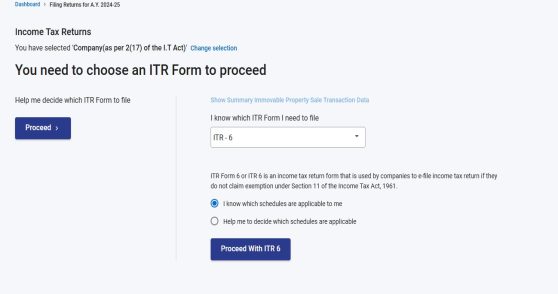

• Click on continue and select the ITR form i.e. ITR-6 in our case.

.

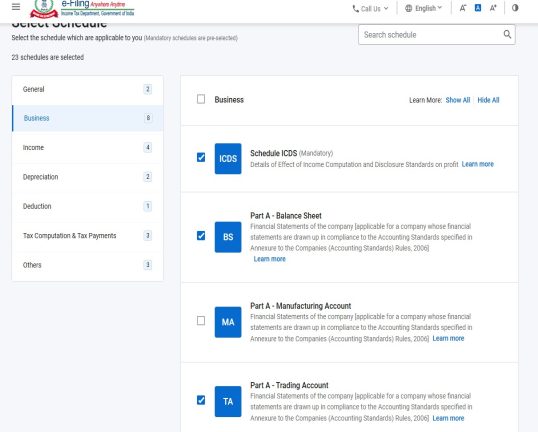

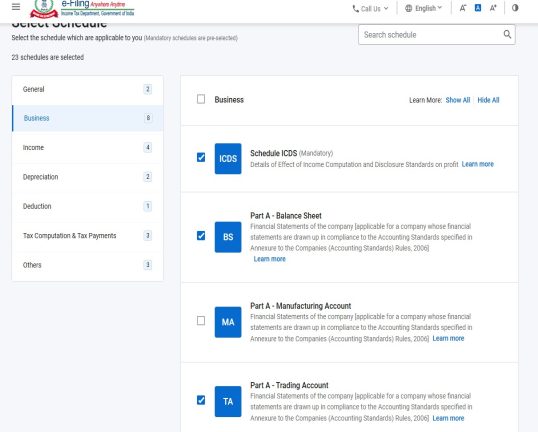

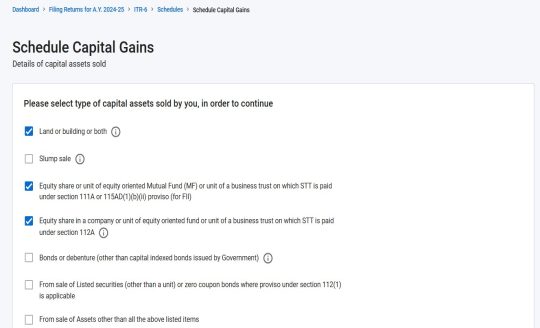

• Select the schedules that are applicable to you from the given schedules.

.

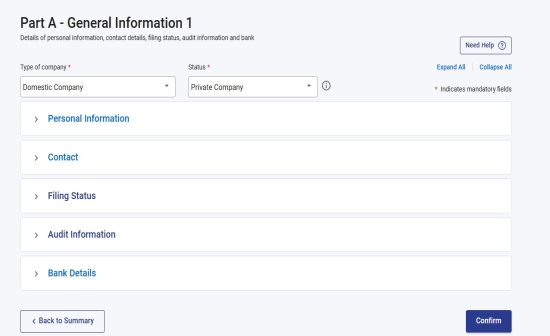

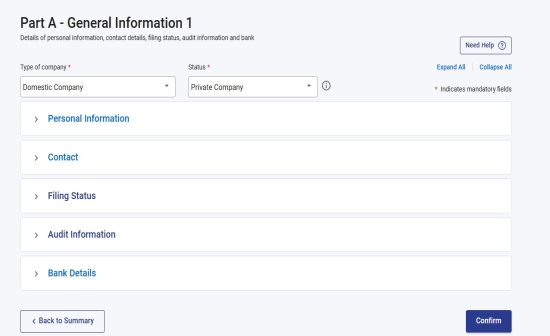

• The next step is to fill the basic details like CIN number, date of start of business etc. In this the basic details are divided into 2 parts, first part contains details like whether your registered under MSME, whether you are liable to audit etc., The second part contains details like Key person details, shareholder information (shareholders having more than 10% holding), nature of company etc.

.

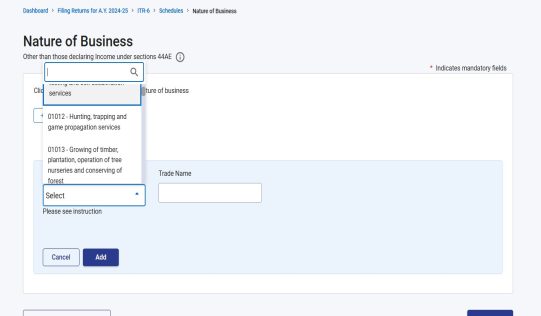

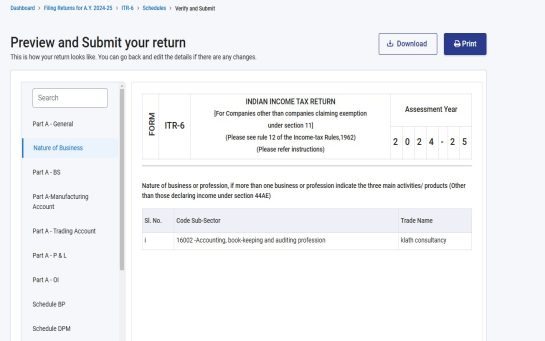

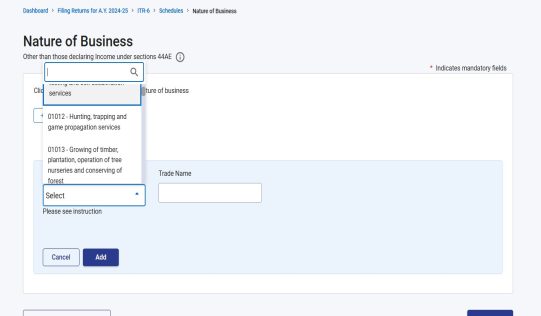

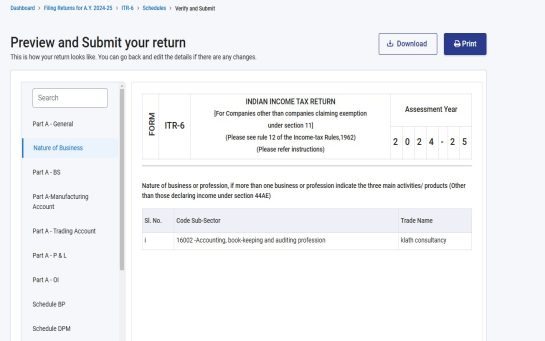

• The next step is to fill the nature of business of the entity.

.

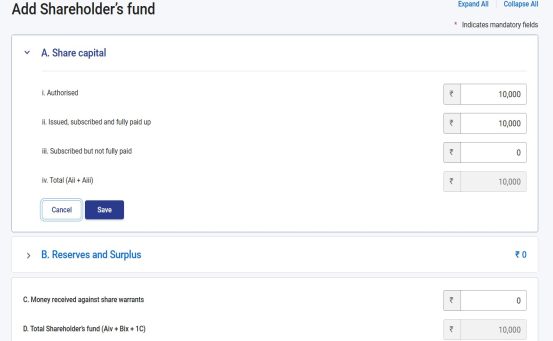

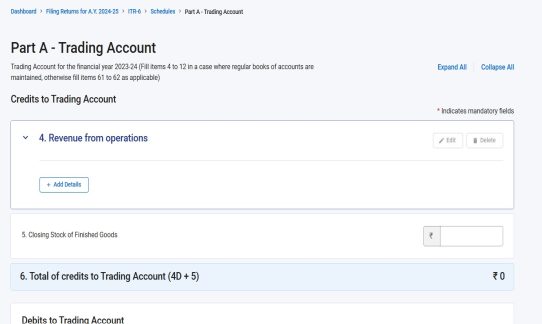

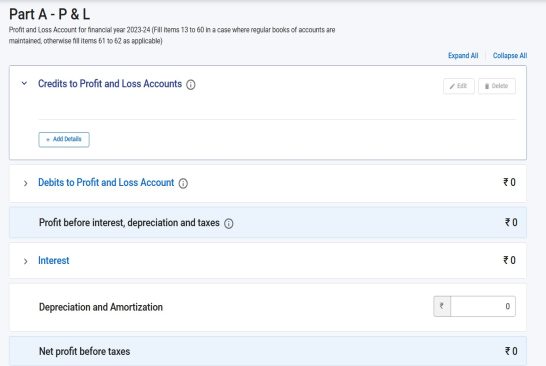

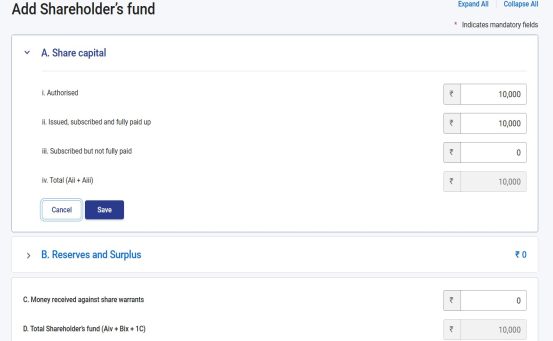

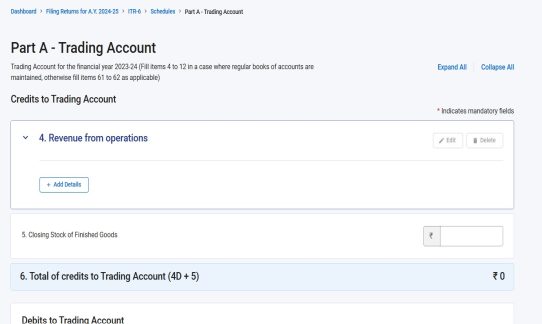

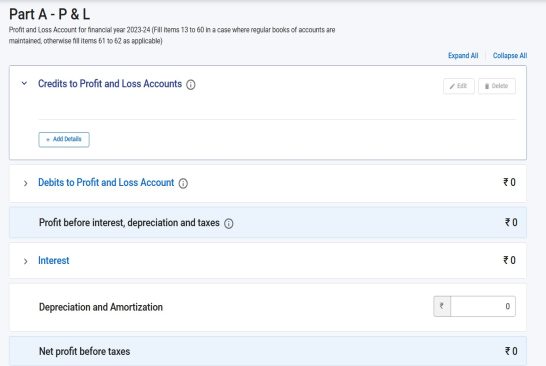

• The next step is to business income schedules like schedule Balance sheet, Profit & loss account, Trading account.

.

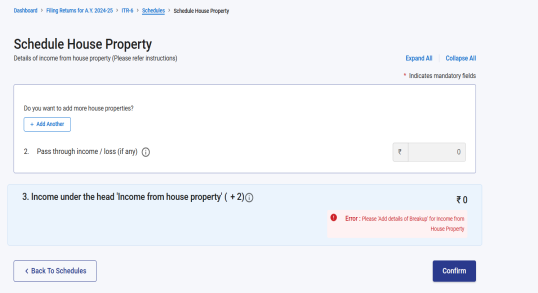

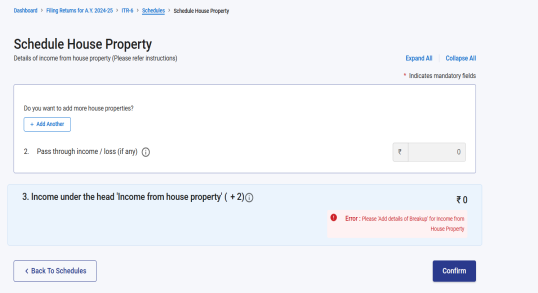

• The next step after filing the schedule house property if you have any income from house property.

.

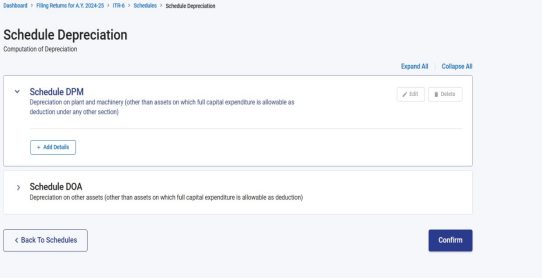

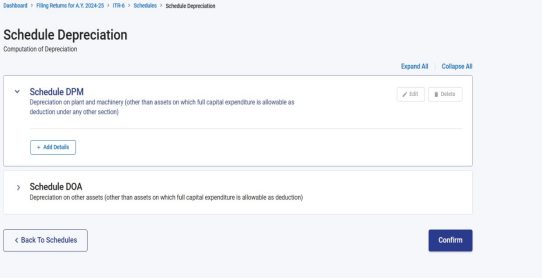

• The next step is to fill the schedule depreciation.

.

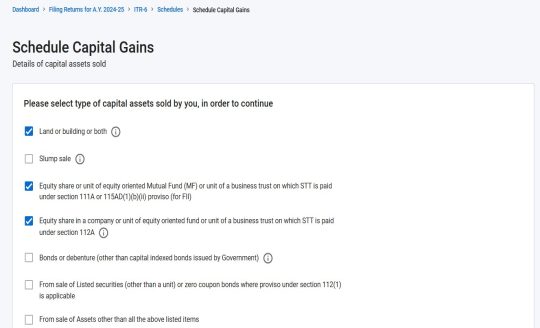

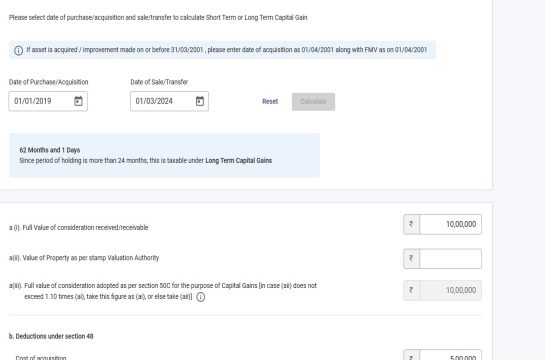

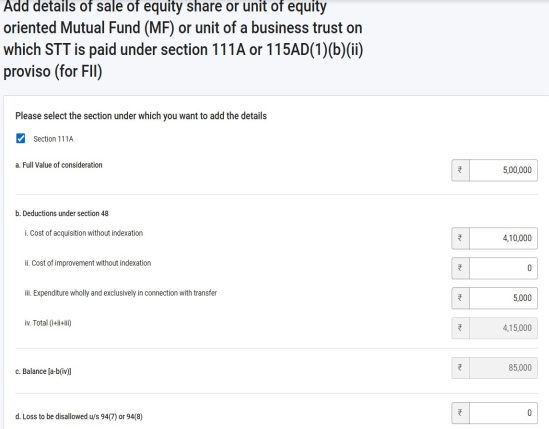

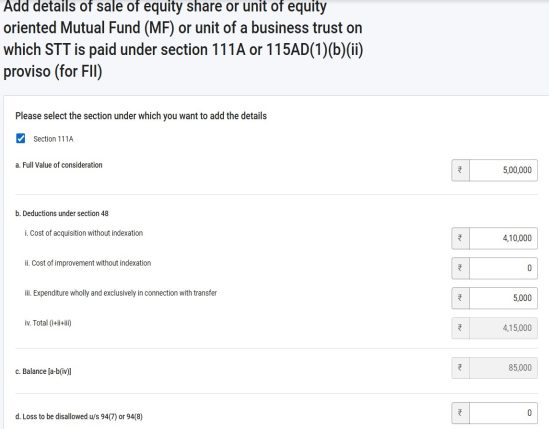

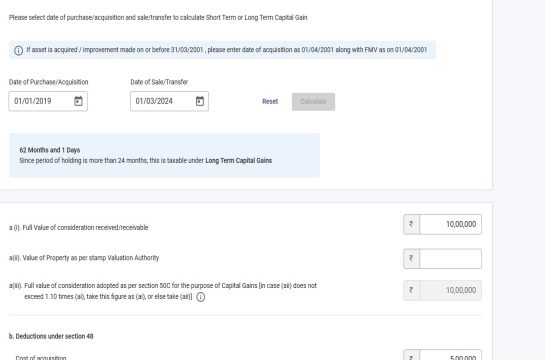

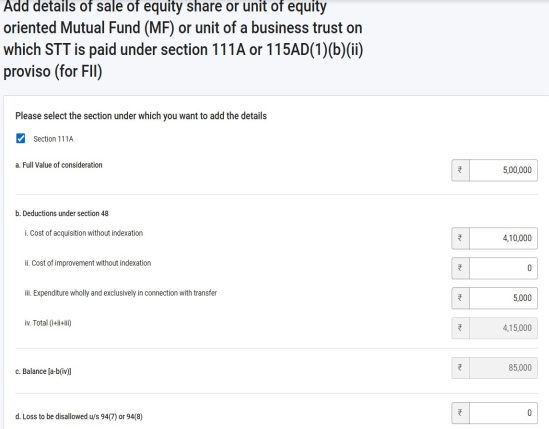

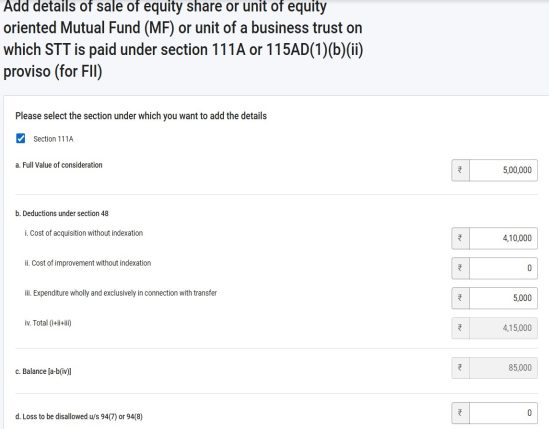

• The next step is to fill the schedule capital gains by bifurcating the capital gain into long term & short-term capital gains.

.

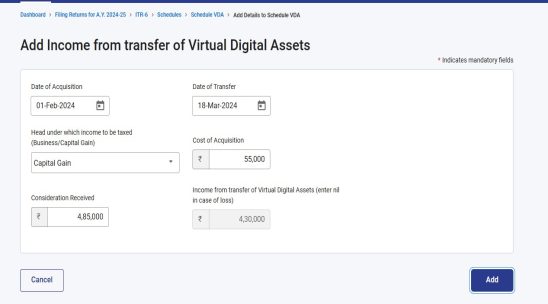

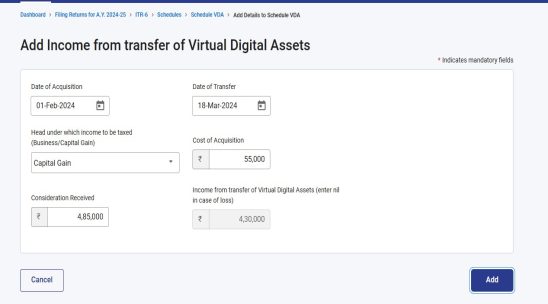

• The next step is to fill the Schedule VDA if you any income form virtual digit asset.

.

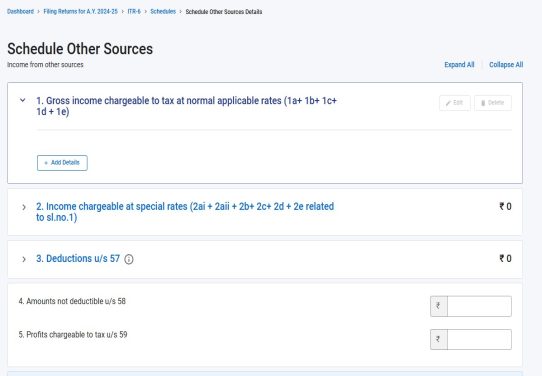

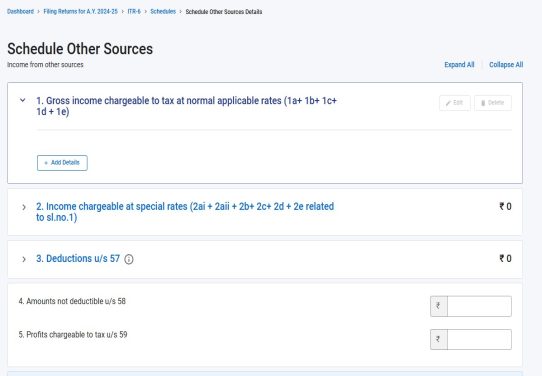

• The next step is to fill details of income received the entity from other sources like dividend, interest etc.

.

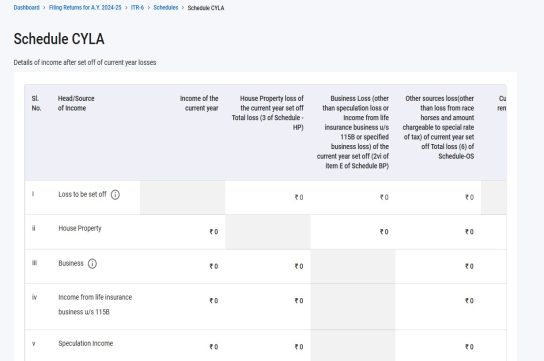

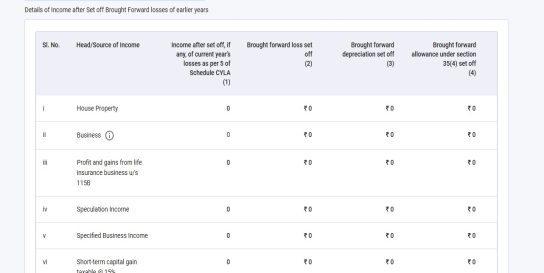

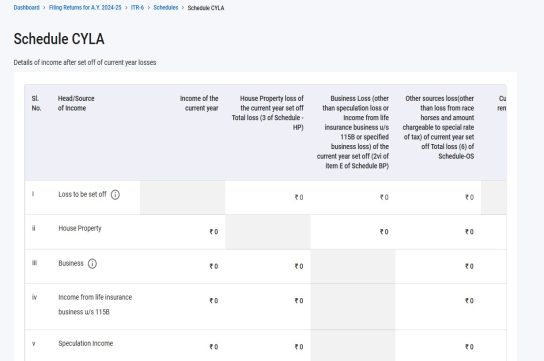

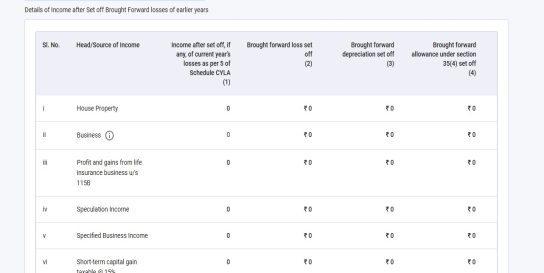

• The next step is to check the Schedule of current year losses and Schedule carry forward loss to correctly update your losses and carry forward if applicable.

.

.

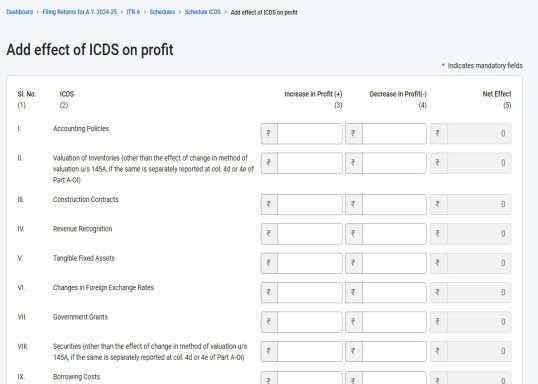

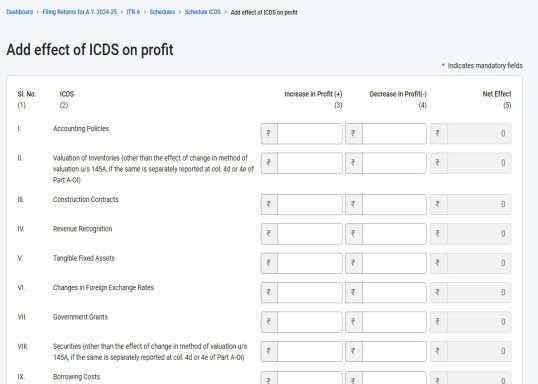

• The next step is to explain the effects of ICDS (Income computation disclosure standards) on profit.

.

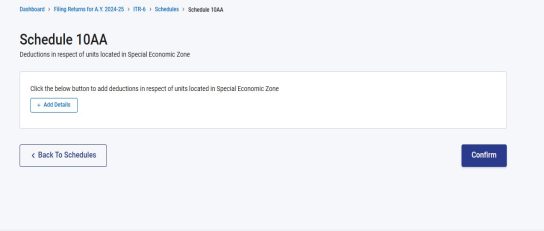

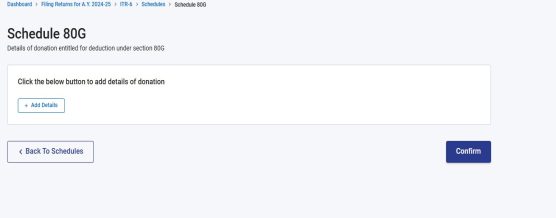

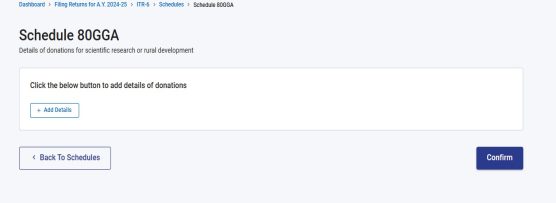

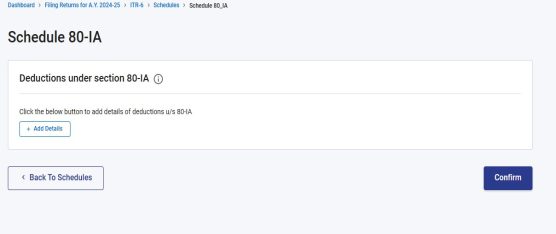

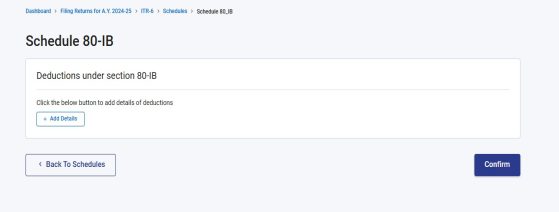

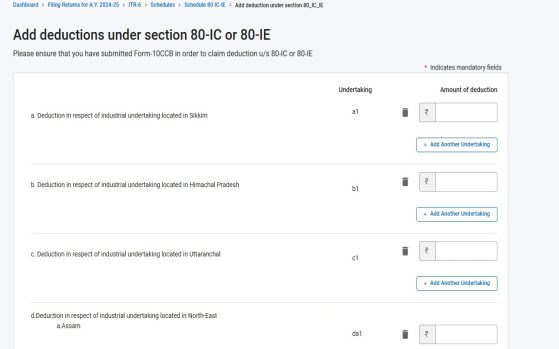

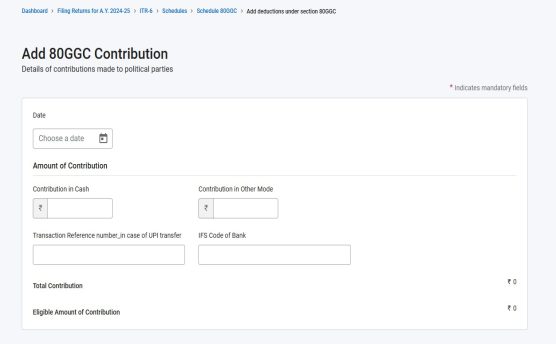

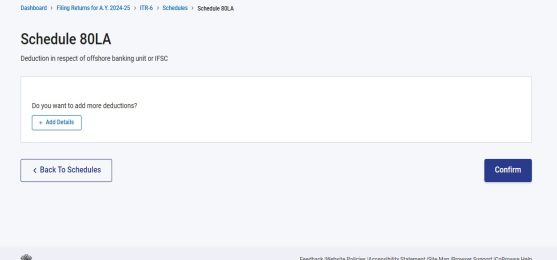

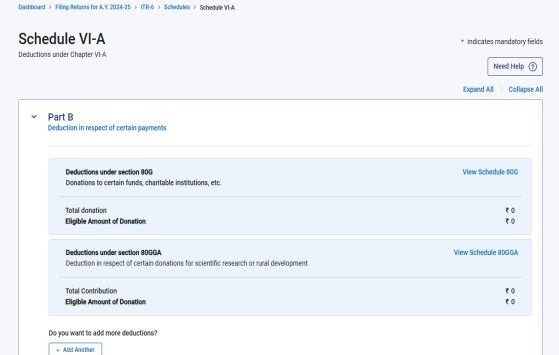

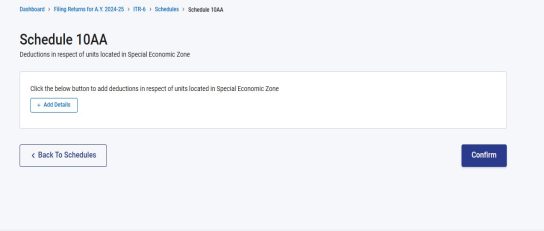

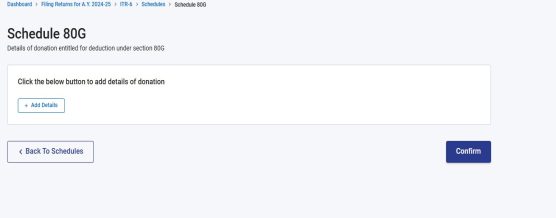

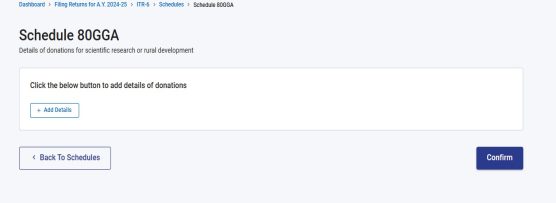

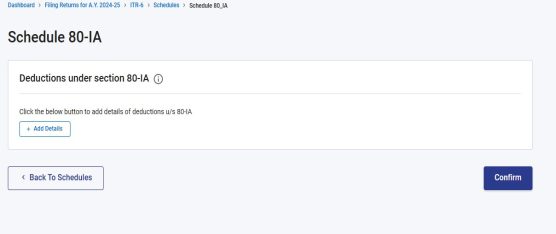

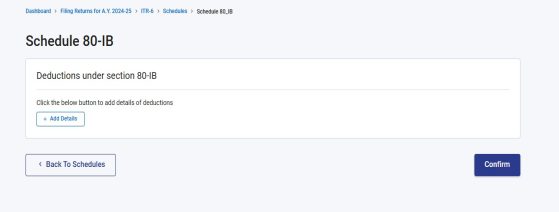

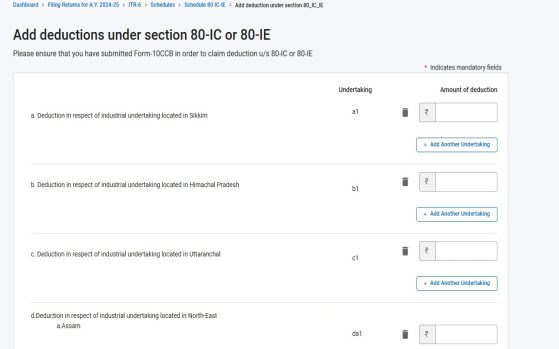

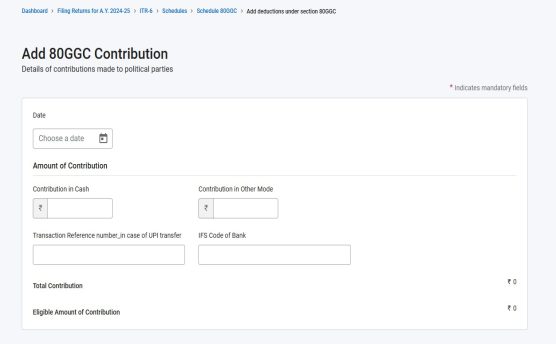

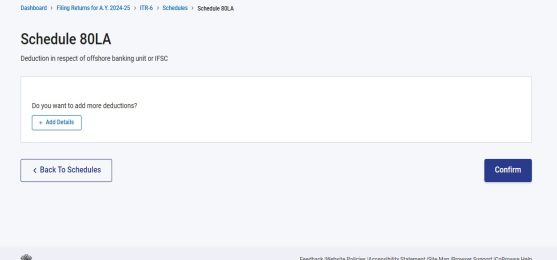

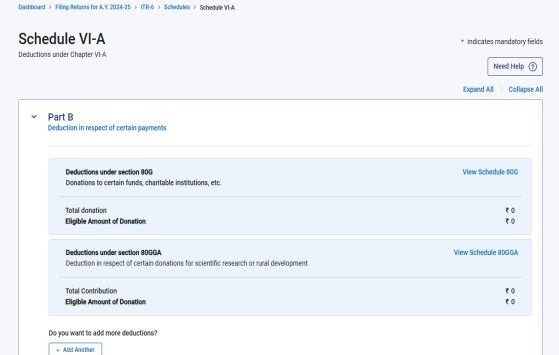

• The next step is to fill deduction under various section like 10AA, 80G, 80GGA, 10IA, 10IC etc.

.

.

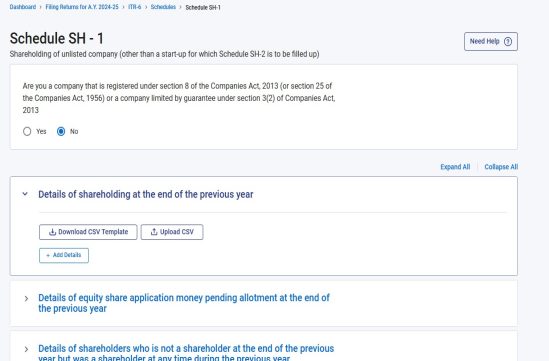

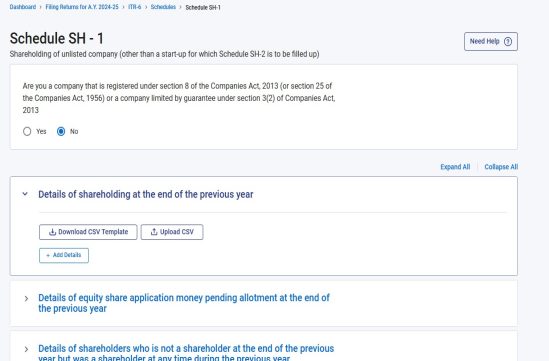

• The next step is to fill schedule SH-1. In this unlisted company has to fill details of its shareholders

.

.

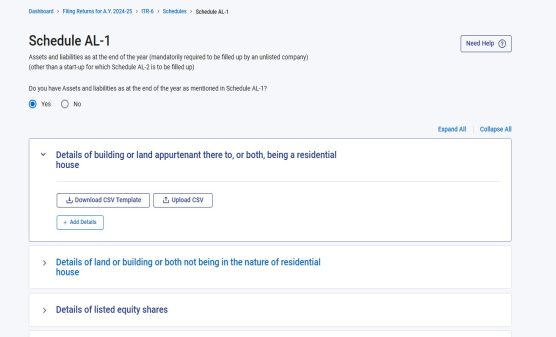

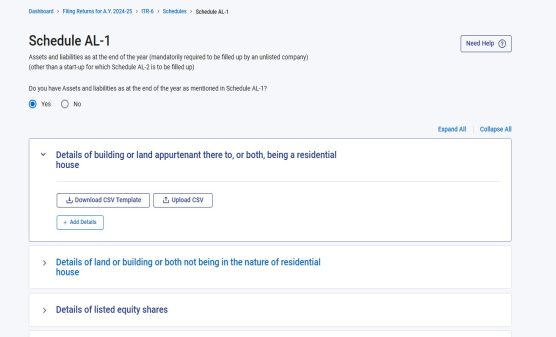

• The next step is to fill the schedule AL-1, wherein an unlisted company is to fill details regarding Assets & Liabilities as at the year end.

.

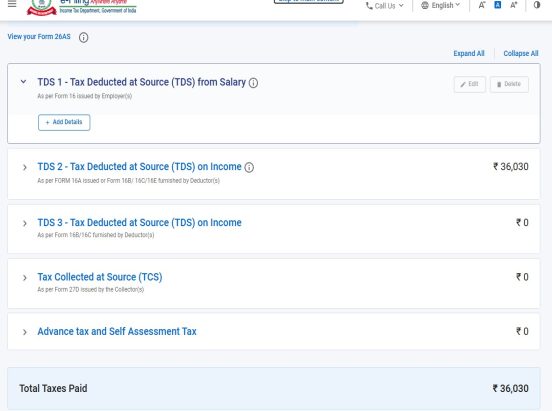

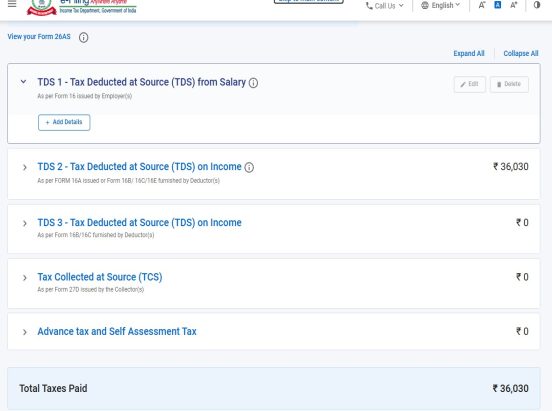

• The next step is to verify the details of taxed paid by you including the TDS deducted and TCS collected from you.

.

• The next step is to click on total tax liability, wherein the system will automatically calculate your tax liability and if taxes paid is greater than the tax liability you will be entitled to get a refund and if the tax liability is more than the taxes paid then pay the remaining tax liability.

.

• After that click on preview return and verify the inputs provided by you

.

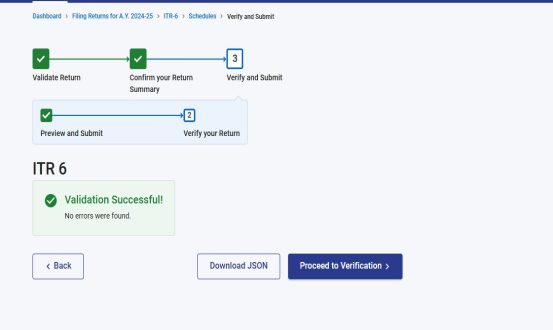

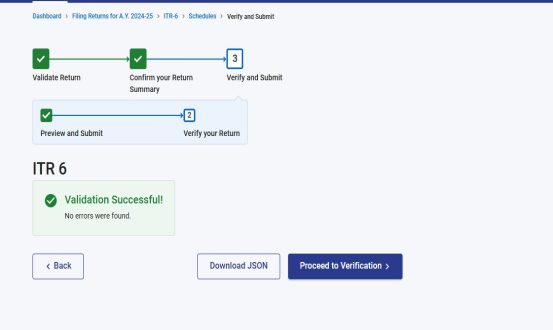

• Click on proceed to validation, if any error occurs clear the error and click on proceed to verification.

.

.

• E-VERIFICATION– Note that ITR-6 can only be verified using DSC (Digital signature) of any one the directors and not by any other means.

.

Add a Comment