ITR-4

1.WHAT IS ITR & WHAT ARE THE TYPES OF INCOME TAX RETURNS?

ITR stands for Income Tax Return, it is a form through which the amount of income earned, and taxes paid by the person during a particular year is communicated to the Income Tax Department.

Types of Income Tax Return

• ITR 1(also known as SAHAJ) for individuals.

• ITR 2 for individuals having capital income.

• ITR 3 for individuals having business income.

• ITR 4 for individuals declaring income under presumptive scheme.

• ITR 5 for llp & partnership firms.

• ITR-7 for ngo, trust, societies claiming benefits of 12a & 80g.

.

2.WHO IS ELIGIBLE TO FILE ITR-4?

Following are eligible to file ITR-4: –

• Individuals having income from Salary or income from Pension.

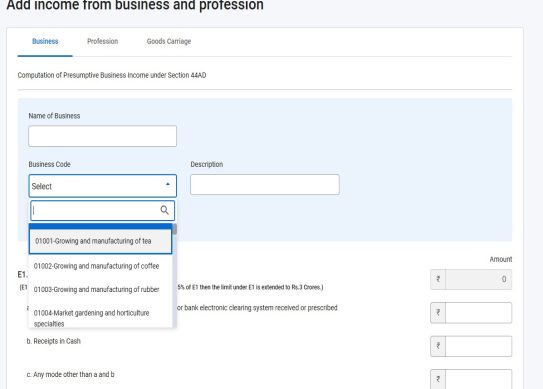

• Individuals having income from business or profession which in computed on presumptive basis (44AD, 44AE, 44ADA).

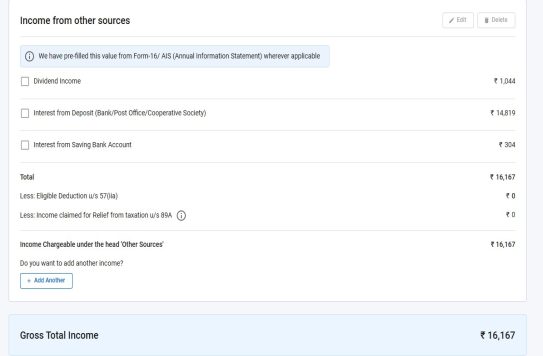

• Individuals having income from interest, dividends, family pension taxable under other sources.

• Individuals having income from one house property.

• HUF/ Partnership firms (not including LLP) having business income which is computed on presumptive basis.

.

NOTE:

The turnover limit for 44ad & 44ada is Rs. 3 crore and Rs. 75 lakhs respectively and the limit for 44ae is up to 10 vehicles.

.

3.WHO ARE NOT ELIGILBE TO FILE ITR-4?

ITR-4 cannot be filed by: –

• A person whose total income exceeds Rs. 50 lakhs.

• Person who is a partner or designated partner in Partnership firm or LLP.

• Trust/ Ngo/ Societies etc.

• Person who has incurred loss during the year and want is to carry forward or having any brought forward loss cannot file ITR-4.

• Person who is a director in company.

• Person who has unlisted equity shares.

• Person having financial interest in any entity outside INDIA.

• Resident but Not Ordinarily Resident & Non- Resident Indian.

.

.

4.TYPES OF INCOME THAT CANNOT BE SHOWN IN ITR-4?

Following are the types of income that cannot be shown in ITR-4

• Income from sale of capital asset.

• Income from more than one house property.

• Income from winning a lottery.

• Person having commission from insurance business.

• Agriculture income exceeding Rs. 5,000.

• Income from engagement in activity of owning & maintaining racehorses.

• Income that is subject to special rates.

.

5.DOCUMENTS REQUIRED TO FILE ITR-4?

Following documents are required while filing ITR-4

• FORM 16 from employer (if applicable).

• Interest certificates from banks. Post office, Nbfc etc.

• Investment details (if any).

• Donation receipts. (if any)

• Profit & loss accounts.

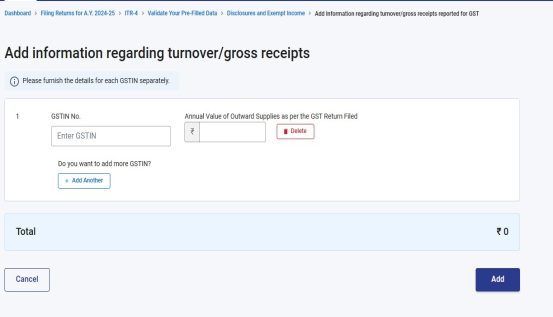

• GST details (if any)

.

.

NOTE:

Since ITR’s are annexure less forms the above-mentioned documents are not to be attached with the ITR Form. However, one needs to keep these documents as it can be demanded by the tax authorities during assessment, inquires.

.

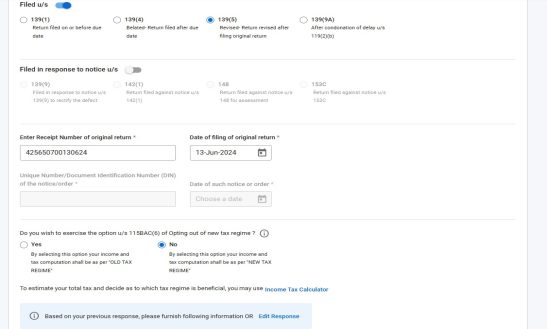

6.HOW TO FILE ITR-4?

By following the steps mentioned below one can file ITR-4

.

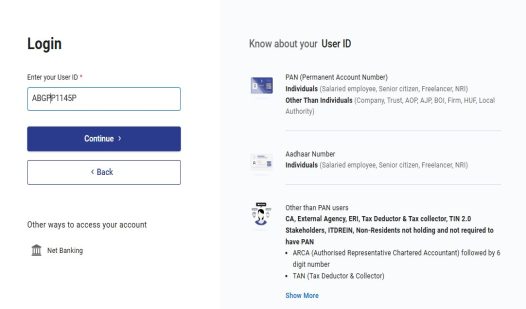

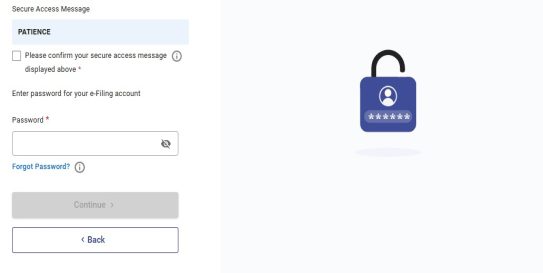

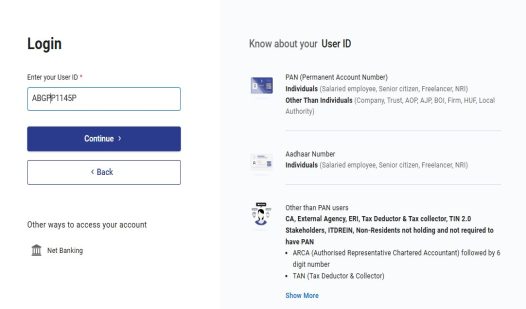

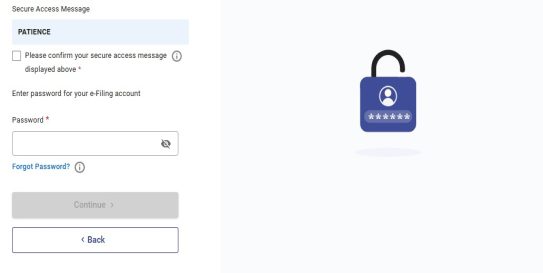

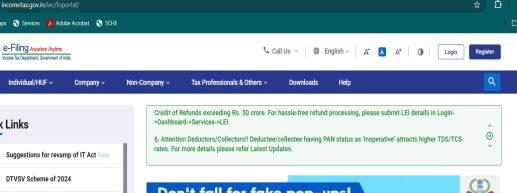

• Click on login and enter your pan & password to login to the income tax portal.

.

.

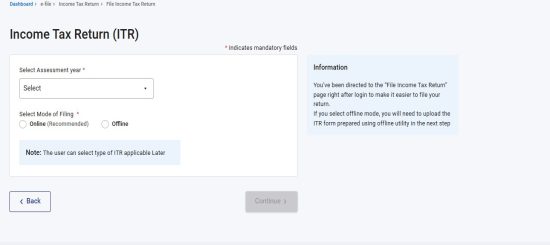

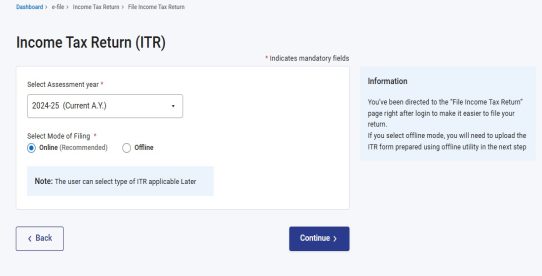

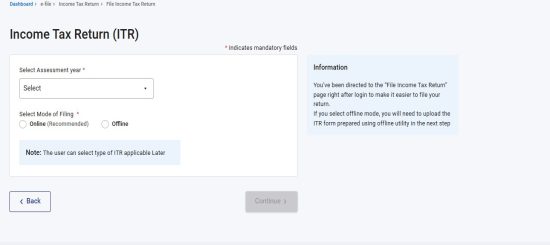

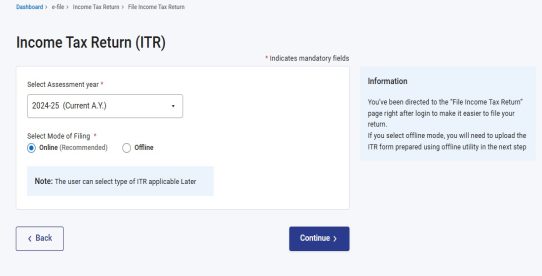

• Click on e-file, then click on file income tax returns.

.

• Select the assessment year for which you want to file ITR and select the mode of filing (here we are telling about online filing procedure)

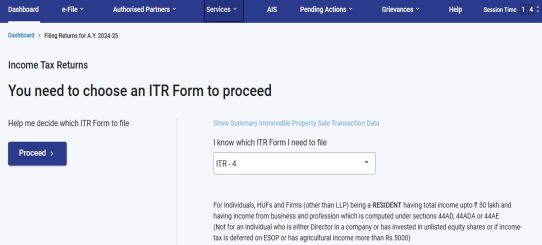

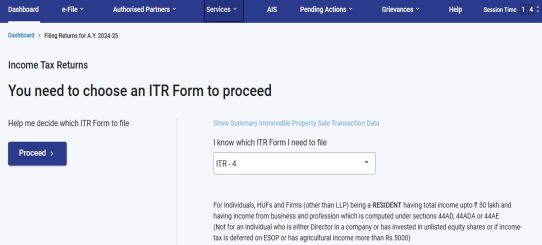

• Click on continue and select the ITR form i.e. ITR-4 in our case.

.

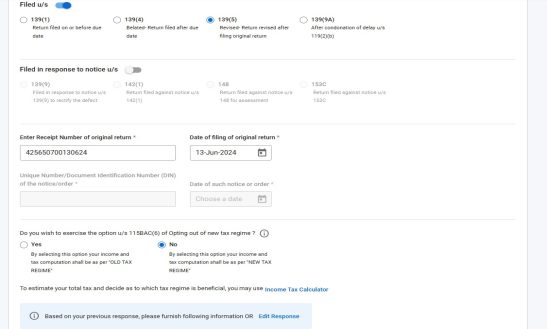

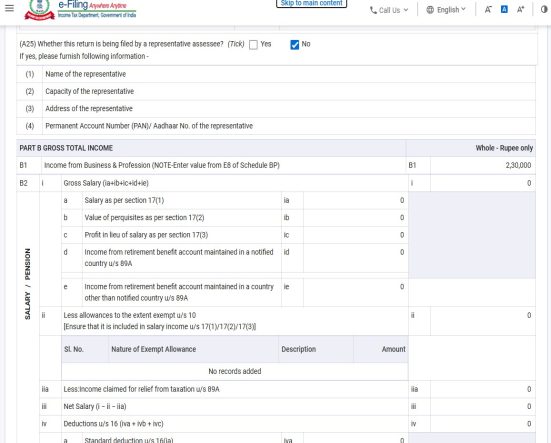

• Click on continue, the form will appear the first step is to fill the basic information & click confirm. In this step up need atleast one pre validated bank to go to further step to file your return.

.

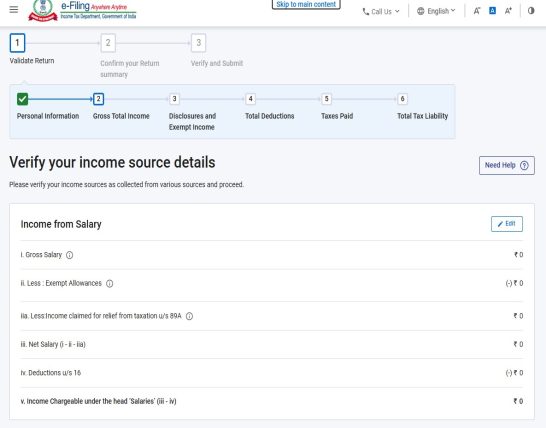

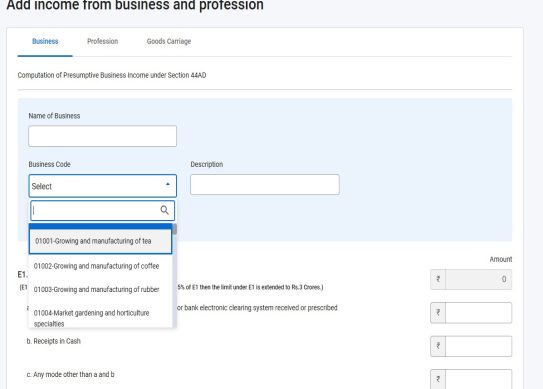

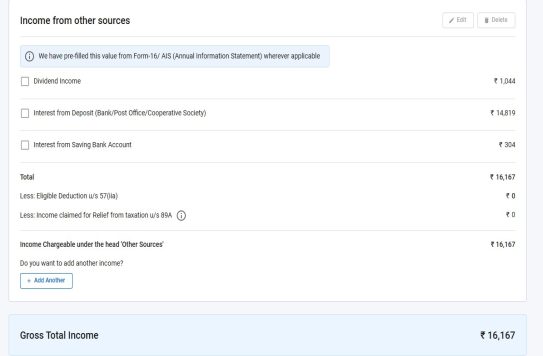

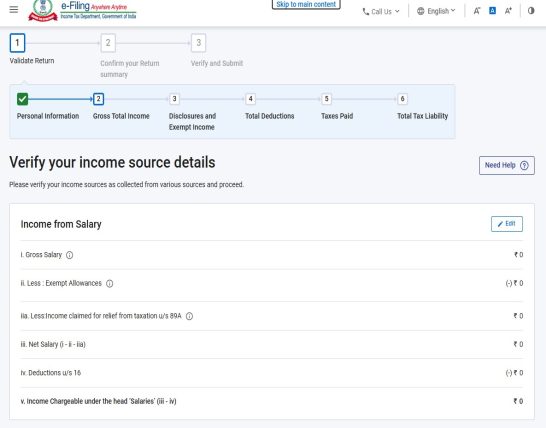

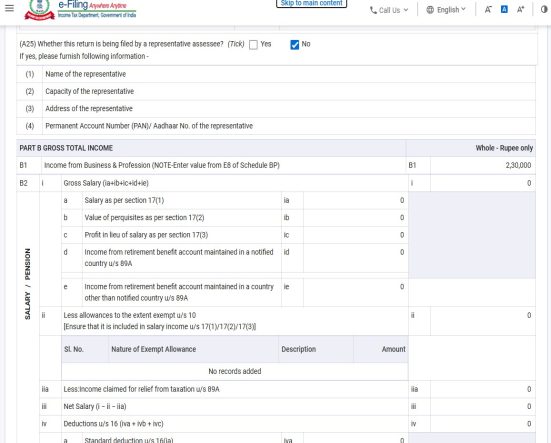

• Second step is to fill the income details the different sources of income one has like income from Presumptive scheme, salary, house property or other sources.

.

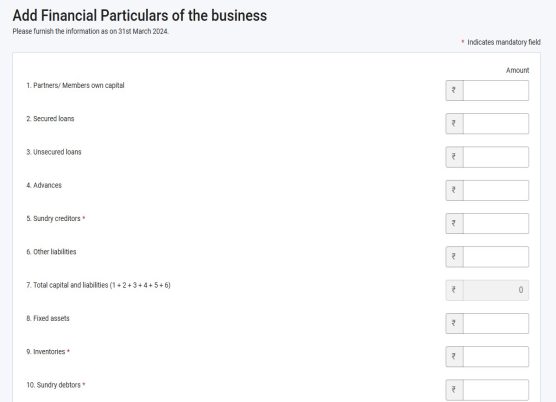

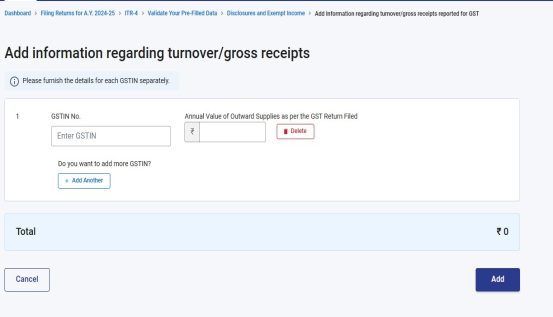

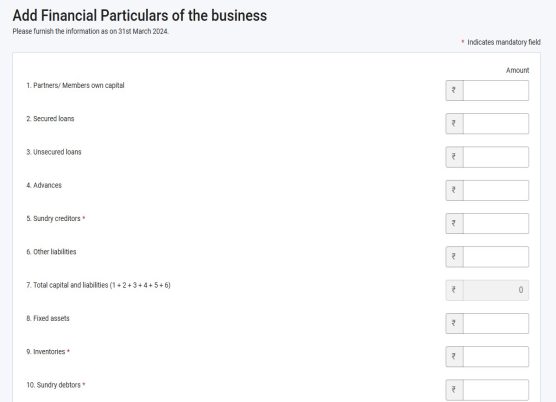

• The next step is to financial particulars and information regarding gst turnover if any.

.

• The next step is to claim the deductions that you are entitled to claim under various sections like 80g, 80d, 80c etc.

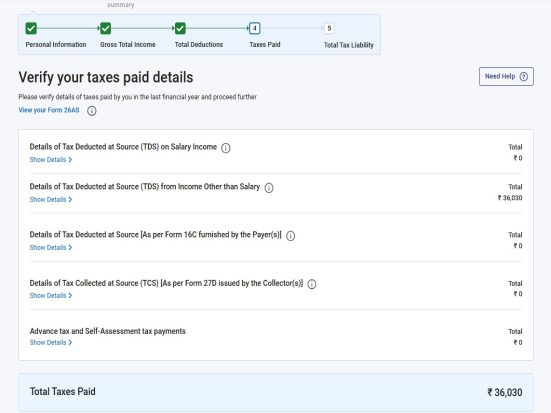

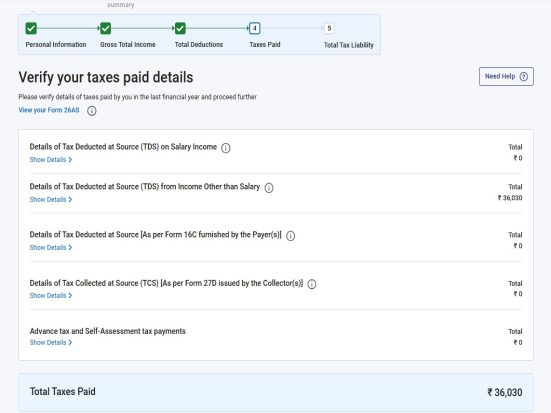

• The next step is to verify the details of taxed paid by you including the TDS deducted and TCS collected from you

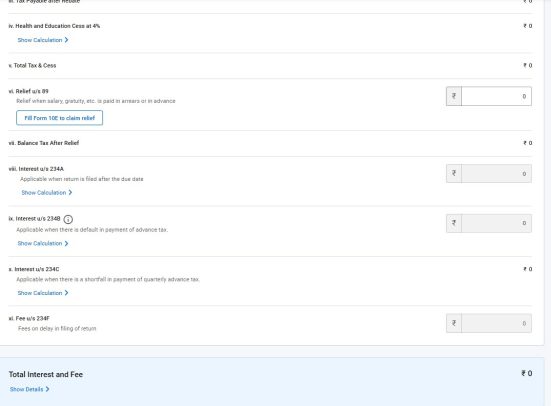

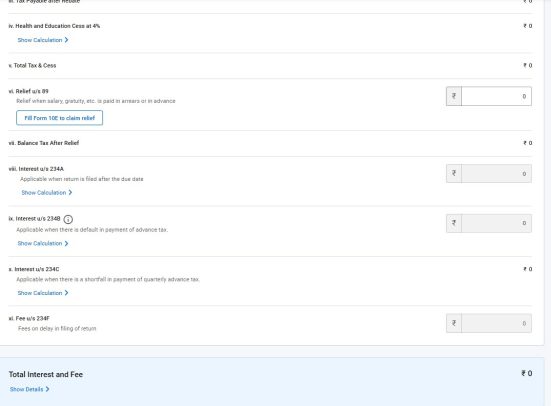

• The next step is to click on total tax liability, wherein the system will automatically calculate your tax liability and if taxes paid is greater than the tax liability you will be entitled to get a refund and if the tax liability is more than the taxes paid then pay the remaining tax liability.

• After that click on preview return and verify the inputs provided by you

.

• Click on proceed to validation, if any error occurs clear the error and click on proceed to verification.

.

• The last step is to verify the return prepared you can verify the return through following methods: –

II.Through digital signature (DSC)

IV.Through pre validated bank account

V.Through pre validated demat account

VII.By sending signed physical copy to the Income tax department, Bengaluru.

.

.

.

.

.

Add a Comment