INCOME TAX REGISTRATION

1.WHO IS REQUIRED TO REGISTER ON INCOME TAX

Each and every person who is holding a valid and active PAN (Permanent Account Number), (Pan is a 10-digit alphanumeric number issued by the department of income tax it consists of both numbers and alphabet).

2.WHO IS REQUIRED TO FILE THE INCOME TAX RETURN?

Since, each & every person holding valid and active PAN is required to register on the Income Tax Portal the next question arises do every person holding PAN is required to file ITR? NO, every person holding PAN is not required to file return, following are the Person required to file ITR: –

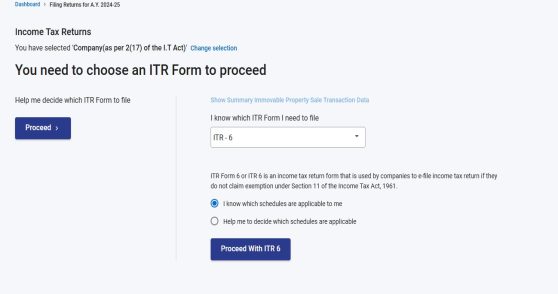

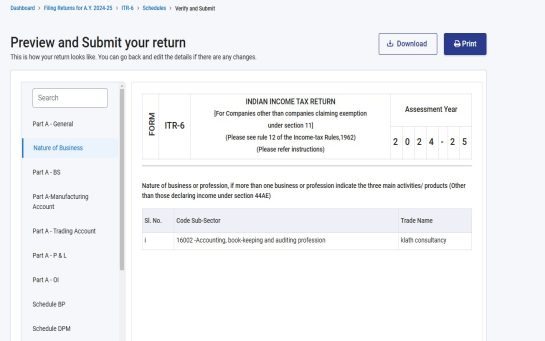

• Every company registered is INDIA, whether it is Public, Private or Foreign Company.

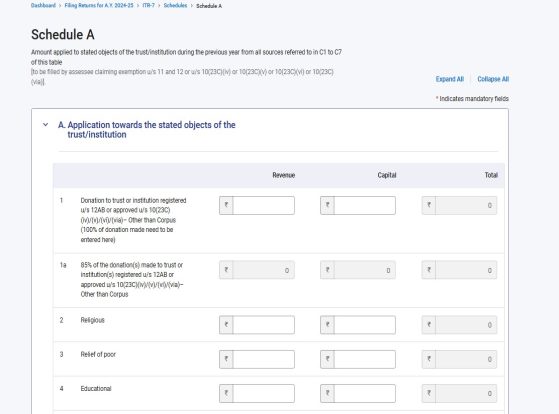

• Trust, NGO, Society availing benefits of 12A/80G.

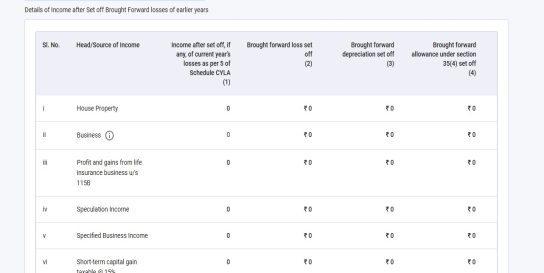

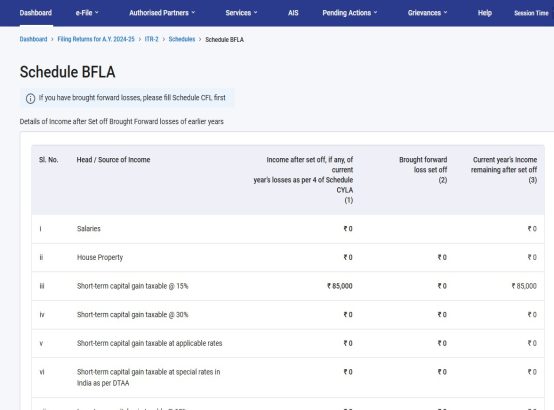

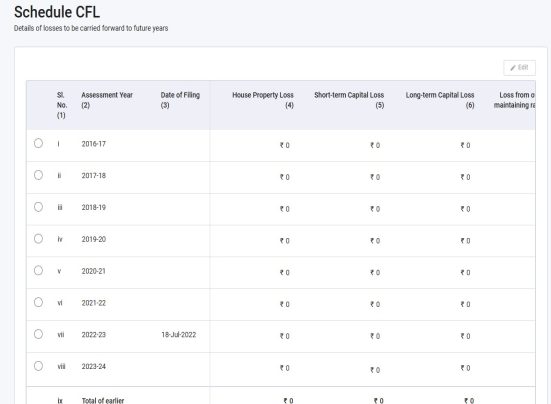

• In case of loss and the assessee wants to carry forward the loss to next year.

• In case the person is eligible to claim Income Tax Refund.

• Individual whose income is ₹ 2,50,000 or more during the previous year (3,00,000 or more for person aged between 60 and 80 years and 5,00,000 for person aged above 80 years)

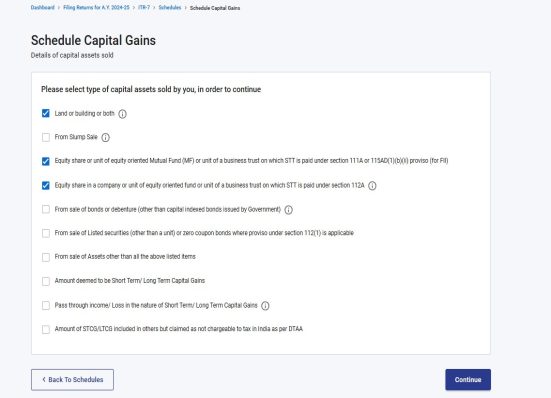

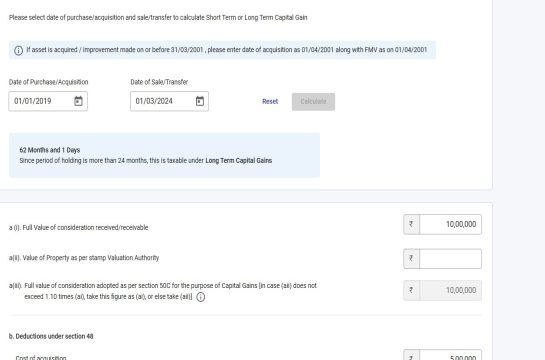

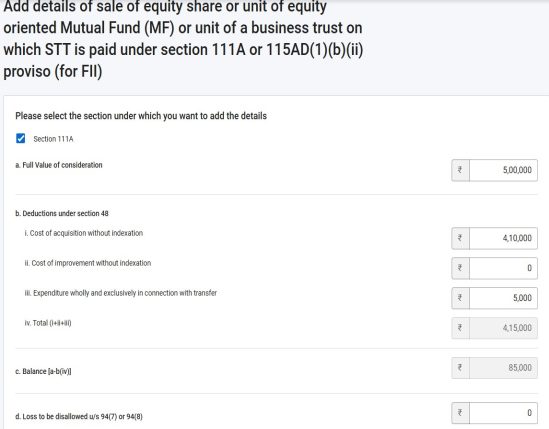

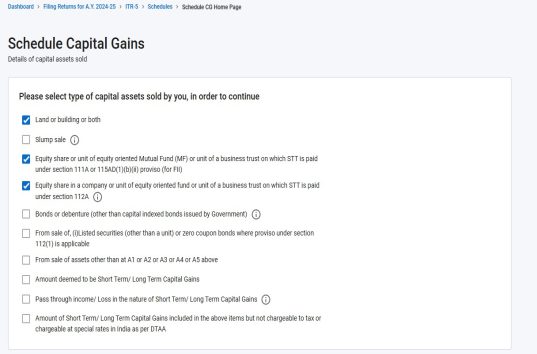

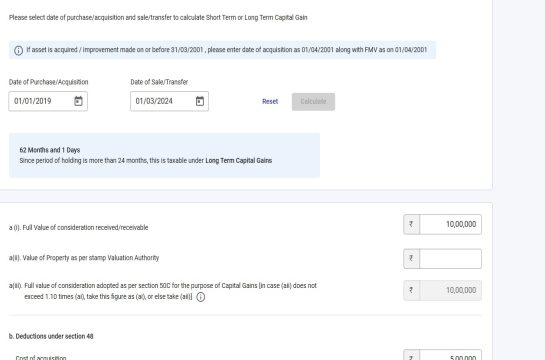

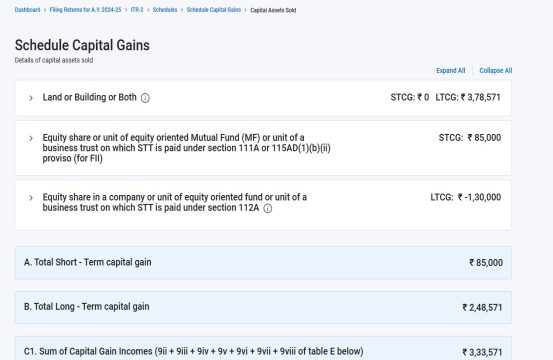

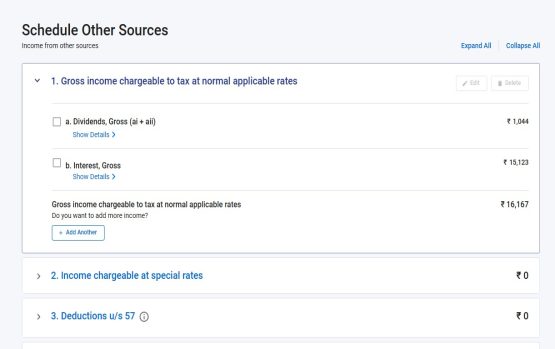

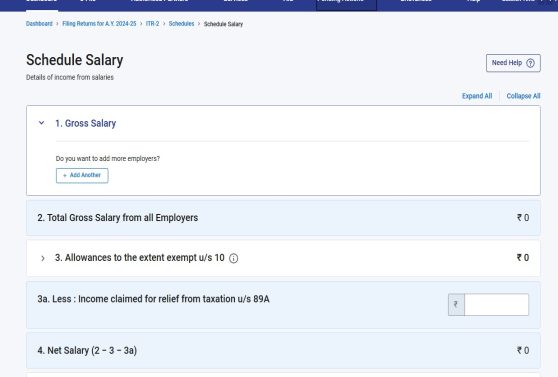

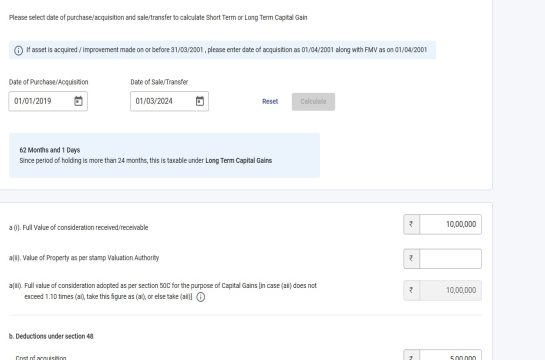

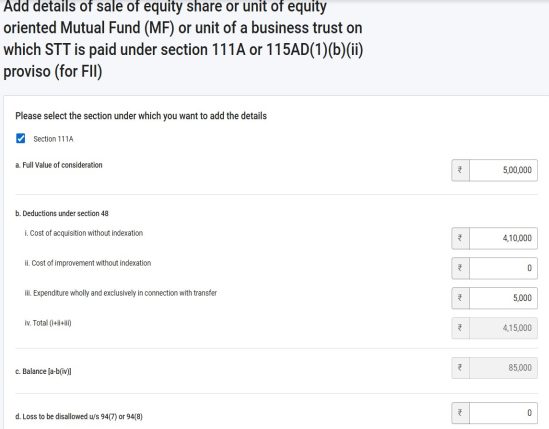

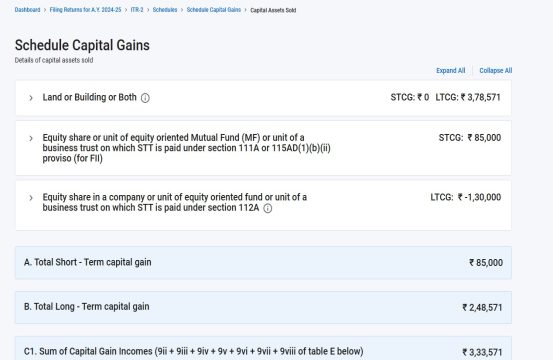

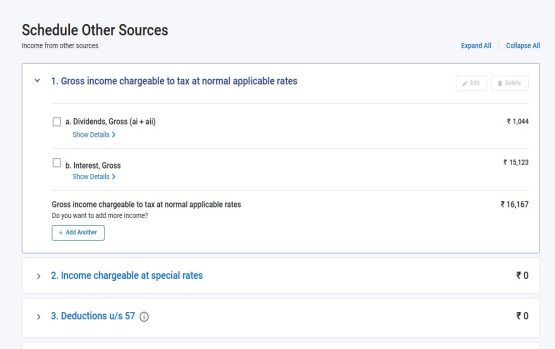

• Individuals having special source of income like income for lottery, capital gains, dividend income etc.

• Person having income from foreign source or have any foreign asset.

• Universities/ college or any other similar institution.

• Alternate Investment Fund/ Real Estate Investment Trust.

.

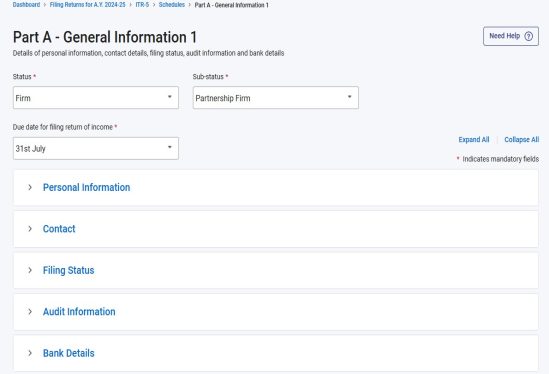

3.DOCUMENTS REQUIRED FOR REGISTRATION

Different assessee required different types of documents for registrartion:

• If the assessee is an individual only valid email and a valid mobile number is required.

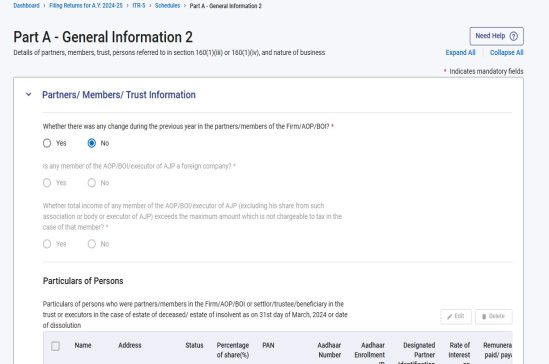

• If the assessee is a Company/ Partnership Firm/ Trust/ Ngo then the following details are required: –

◦ Valid Email id and valid mobile number

◦ Director/ Partner/ Trustee/ Member basic details like Pan and name.

.

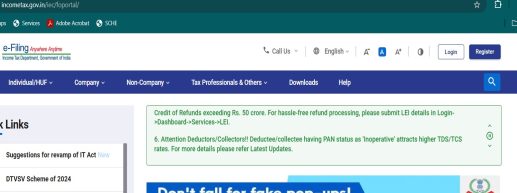

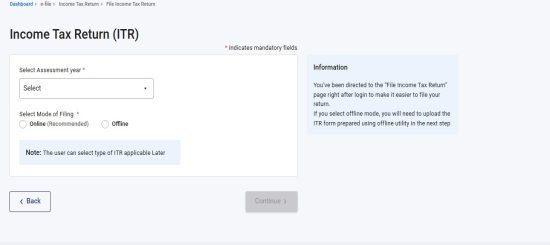

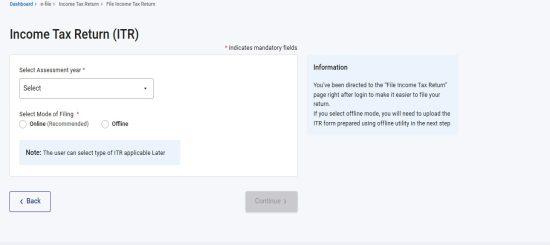

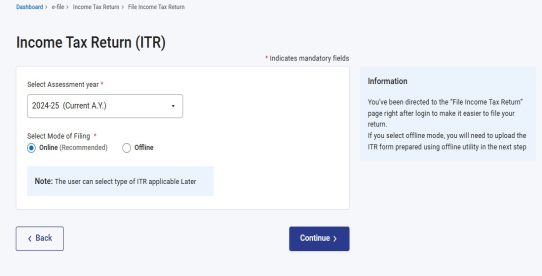

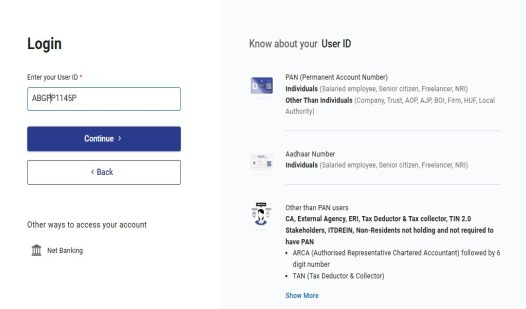

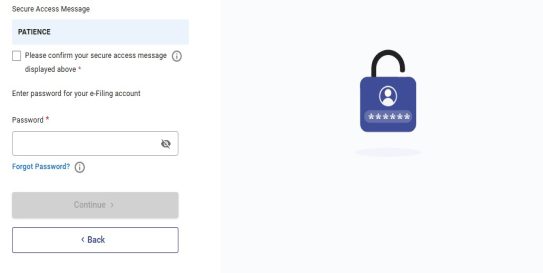

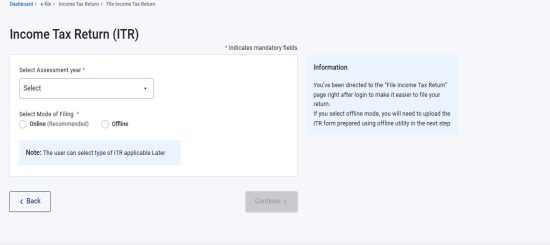

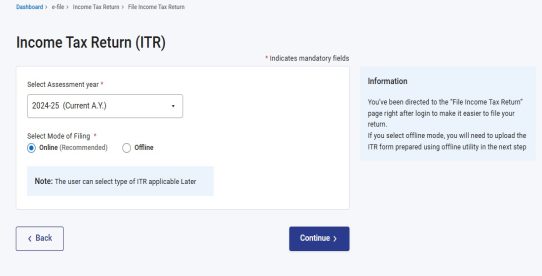

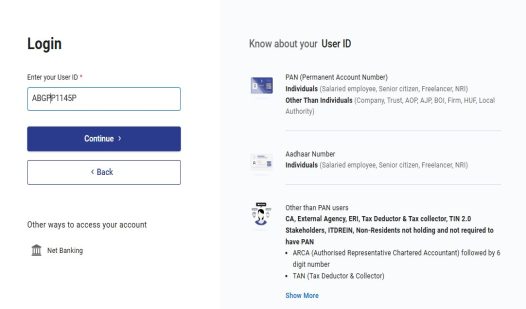

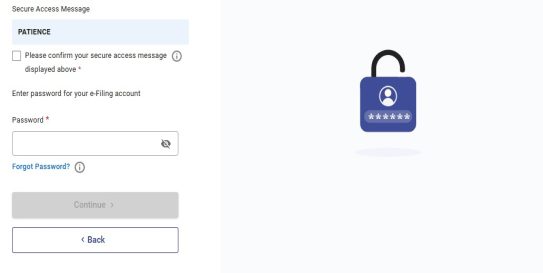

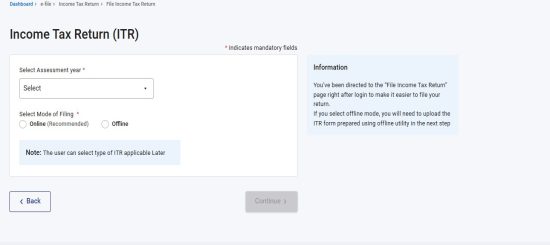

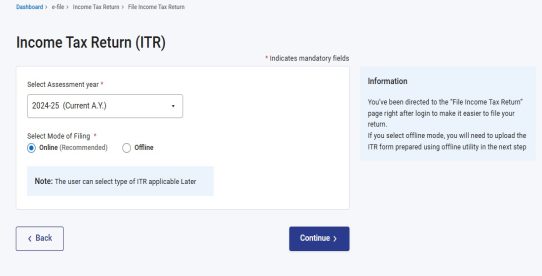

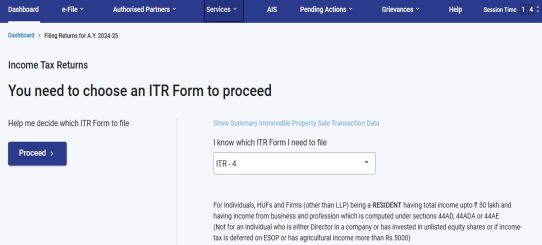

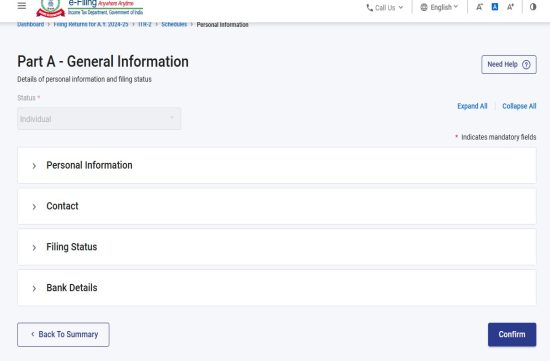

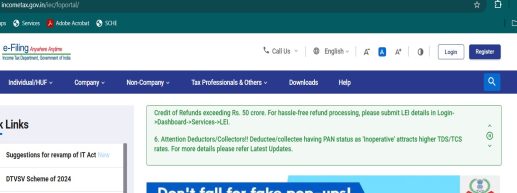

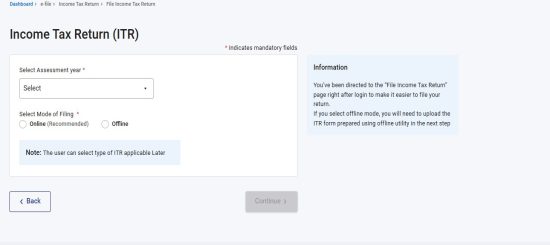

4.HOW TO REGISTER ON INCOME TAX PORTAL

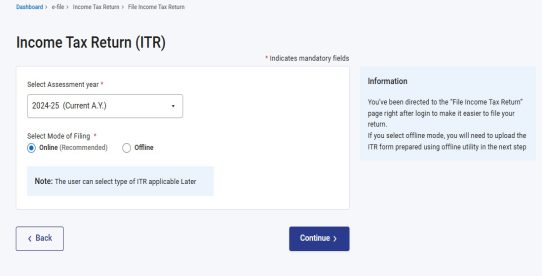

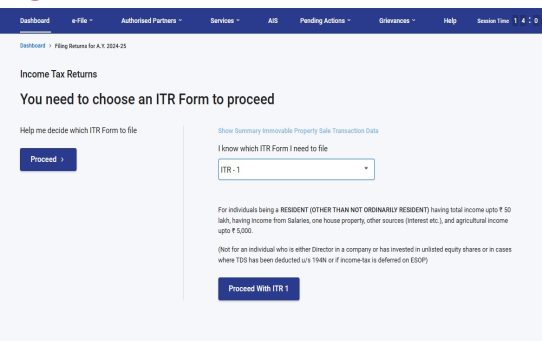

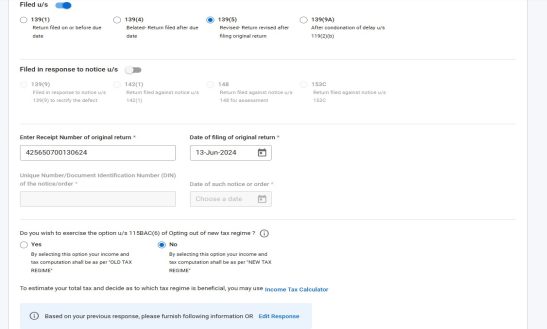

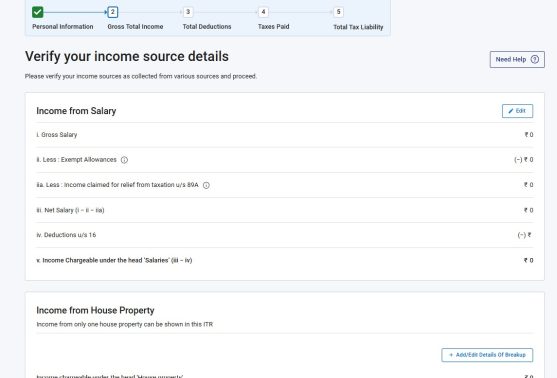

An assesse can get itself registered on the income tax portal by following the below mentioned steps:-

• Click on register on the top right corner.

.

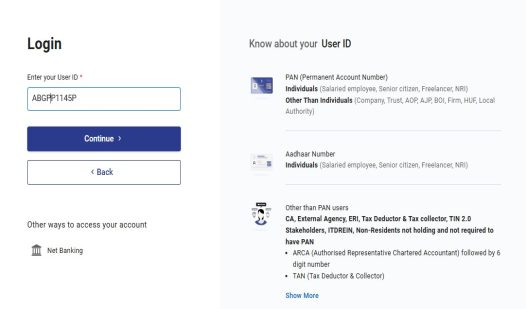

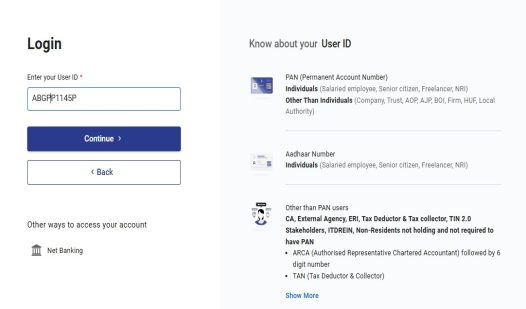

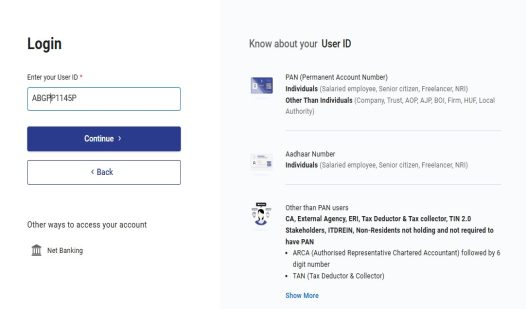

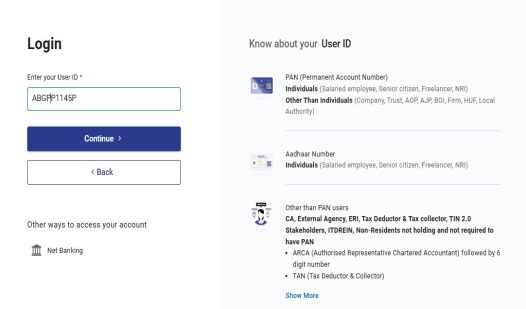

• Enter Pan number and click on validate to validate your PAN.

.

.

.

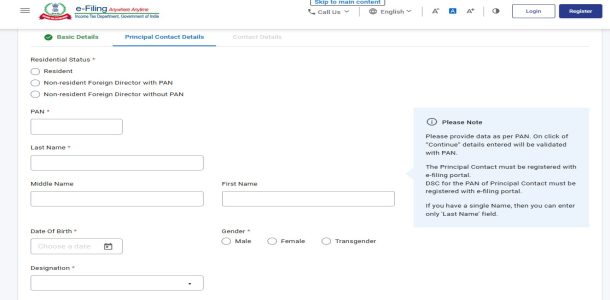

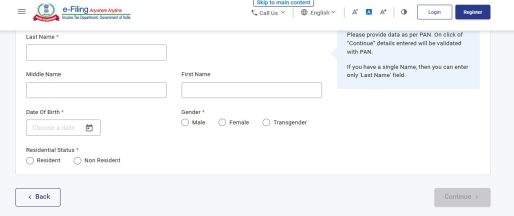

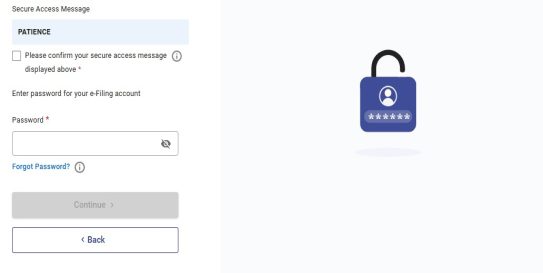

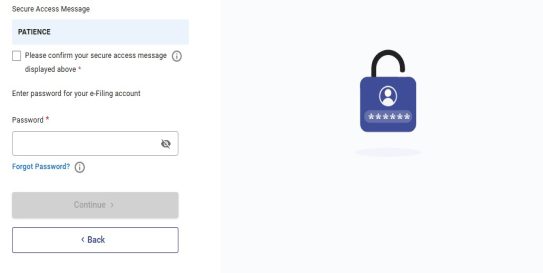

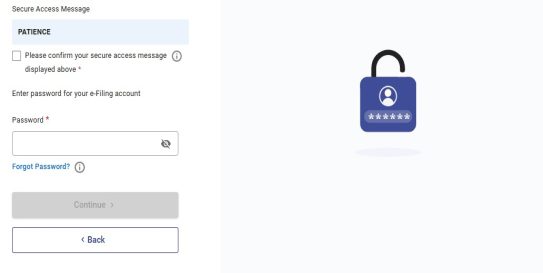

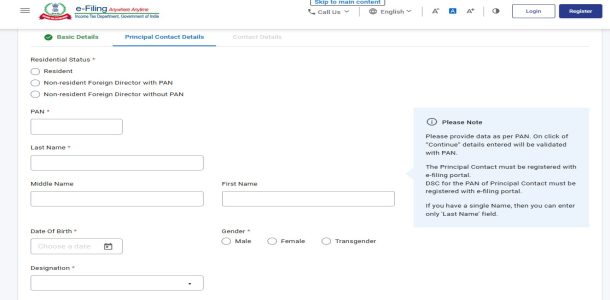

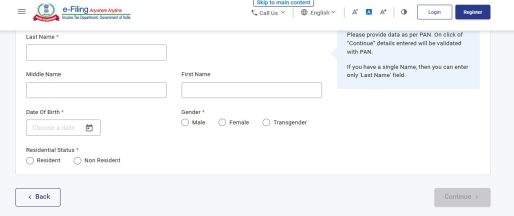

• Click on continue and on the next page enter your basic details like Name, Date of birth, Gender, and Residential Status

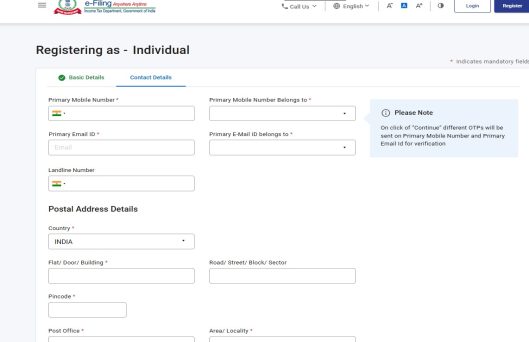

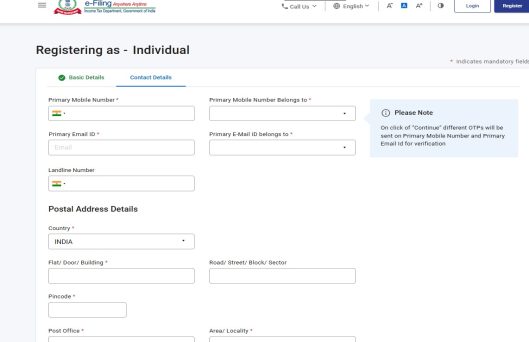

• After entering basic details click on continue, the portal will automatically validate your basic details. On the next page you will be required to fill your contact details like mobile number, email id and address of the assessee.

.

.

.

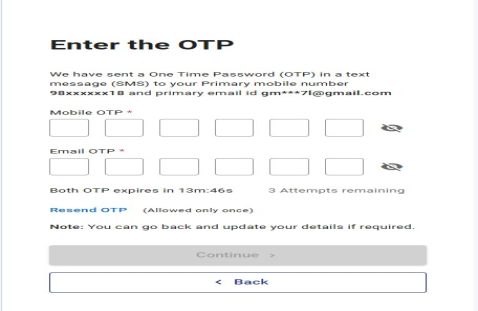

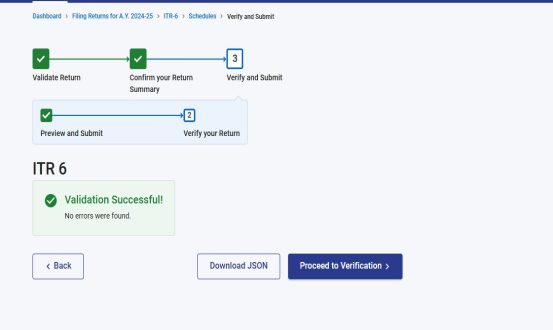

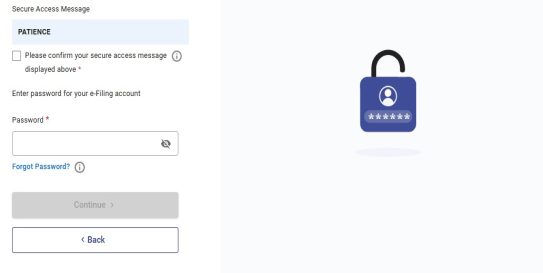

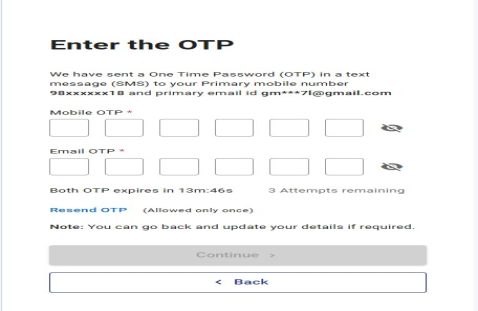

• After entering the details click on continues you will provide the otp on mobile and your email id enter both the otp’s, your registration is successful.

.

.

5.BENEFITS OF REGISTRATION

• INCOME PROOF: – As the income tax returns contains detailed information about the person’s income and the tax paid against it, that makes it the most widely accepted thing as a proof of one’s income.

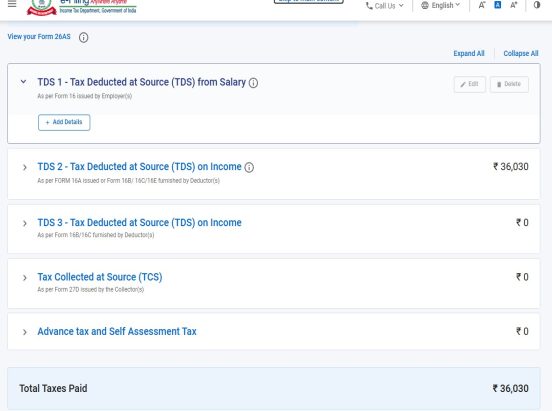

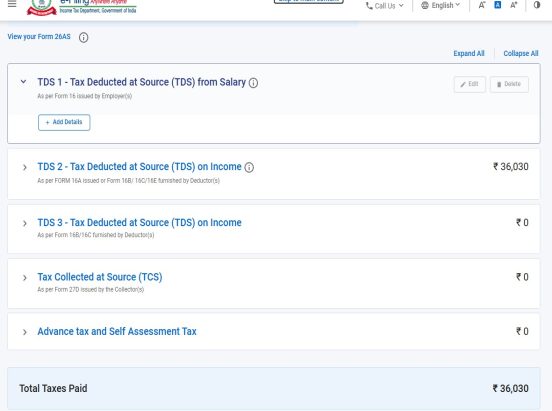

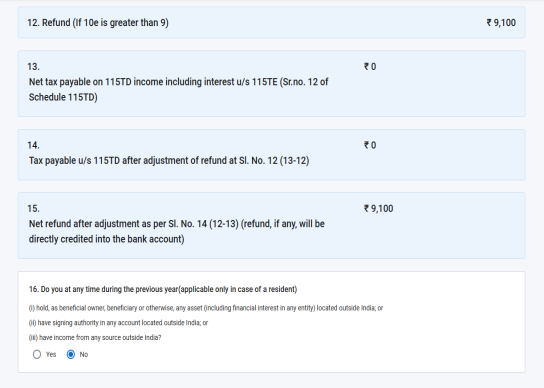

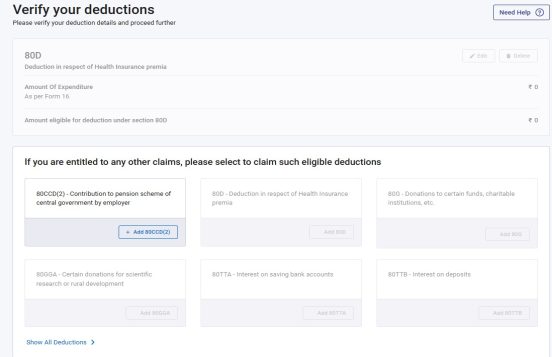

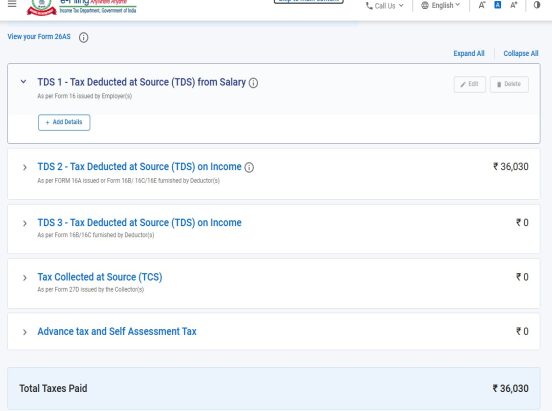

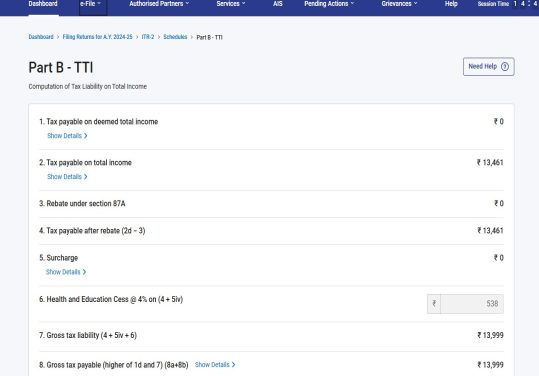

• CLAIMING THE INCOME TAX REFUND: – In case a person or an entity is eligible to claim income tax refund i.e. the tax someone has paid is grater than the tax they are liable to pay then by filing the return they can claim the refund.

• EASY LOAN APPROVAL: For every loan application one need to attach his/her ITR for at least three consecutive years, so it helps in taking loans for business, personal purposes.

• VISA PROCESSING: – Most embassy ask for income tax return while processing visa request of the persons, so if you are planning to apply for a visa most probably you will be asked for to submit your income tax return.

• CARRY FORWARD OF LOSSES: – For carry forwarding of losses to future years filing of ITR is necessary.

• STARTUP VENTURES FUNDING: – While planning to raise capital from outsiders like venture capitalist, the investor might ask for income tax return to evaluate the company financial stability and profitability.

• FOR OBTAINING GOVERNMENT TENDERS: – The contactors who want to apply for government tenders must file the income tax returns on time basis as the scrutiny committee may ask for their income tax returns.

.

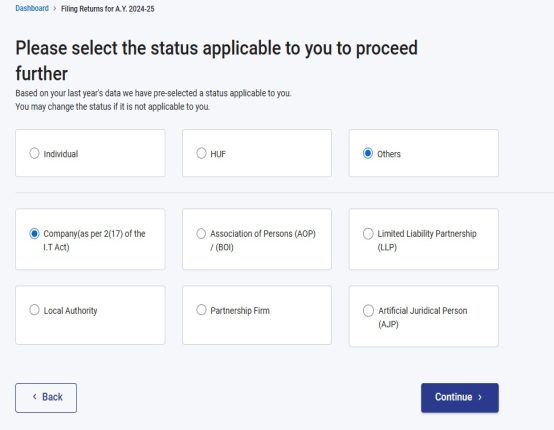

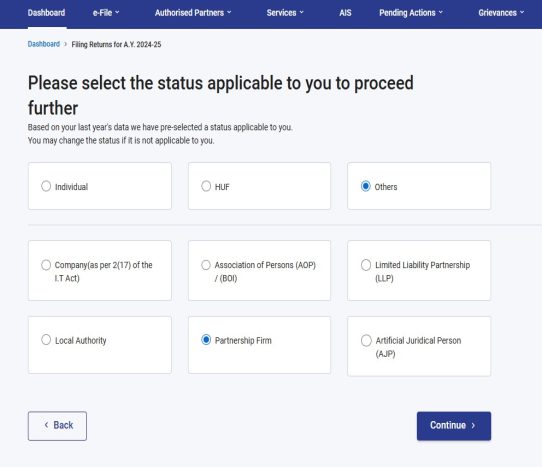

6.TYPES OF ASSESSEE FOR INCOME TAX REGISTRATION

An assesse is person who is liable to pay tax or any sum of money as per the provision of the Income Tax Act, 1961.

.

Section 2(7) of the Income Tax Act defines an assessee as anyone who is required to pay taxes on any income earned or losses incurred in an assessment year. They can also be referred to as every person for whom:

.

• Is there any action being taken under the act to evaluate his income?

• The income of another person for which he is taxes.

• Any loss incurred by him or any other person or persons entitled to a tax refund.

WHO IS A PERSON AS PER THE INCOME TAX ACT, 1961

Following are the categories of persons defined under the Income Tax Act

• Hindu Undivided Family (HUF)

• Association of person (AOP) or Body of Individual (BOI)

• Artificial Juridical body (not covered under any of the above-mentioned category)

CATEGORIES OF ASSESSEE

There can be four categories of assessee: –

• Normal Assessee

An Individual who is liable to pay tax for the income earned during the financial year is known as Normal Assessee.

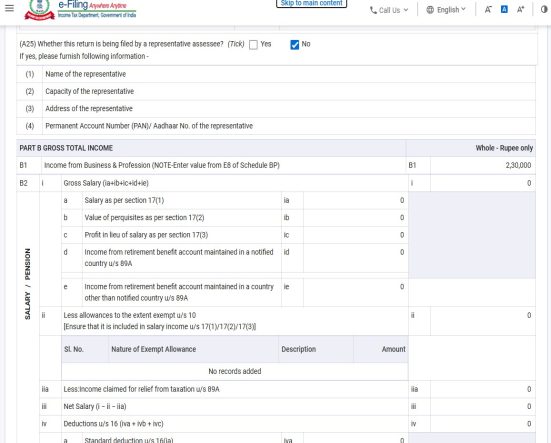

• Representative Assessee

Where a person is liable to pay taxes on behalf of third party is know as Representative Assessee, For eg tax of minor is to be paid by his/ her parent that parent is known as representative assessee.

• Deemed Assessee

Any individual can be assigned the responsibility for paying taxes by the legal authority, such individual are called deemed assessee. For example, legal heir of a deceased person, guarding of a lunatic etc.

• Assessee-in-default

Assessee in default is person who was required to pay the income tax as per the requirements of Income Tax Act, 1961 but has to failed to fulfil his obligations.

If a person sells his house and earns capital gain on such sale of house and fails to pay such tax then such person will be called as Assesse-in-default.

.

.

.